With Wednesday’s show-and-tell event showcasing an expanded mix of new products and services, Apple firmly planted in the ground three new pathways for growth, which is important for the company and the stock. These launchpads create opportunities to develop new businesses, which will provide upgrade cycles to boost Apple revenue.

Prime among the announcements Wednesday was the unveiling of Apple TV designed to be a football to control television sets across the world. Many companies have tried, including Comcast and Samsung, to capture market share in the so-called smart TV market with limited success. What has been missing is the ability to easily integrate applications from the established app store into the TV experience. Apple TV is an attempt to be the preferred choice of consumers as on-demand TV becomes more prevalent.

The second launchpad opportunity is also related to Apple TV: Apple’s foray into gaming. I suspect that more established competitors providing a richer gaming experience like PlayStation and Xbox are not Apple’s target. Instead, a more expansive reach to the non-fervent gaiPamer is clearly the mission. Companies like Nintendo, which have focused on providing more mainstream gaming experiences, could have the most to fear from Apple’s foray into the space. Still, this is clearly a work in progress and it will take significant time for Apple to make progress in becoming an essential gaming hub for the family. This pathway is a start.

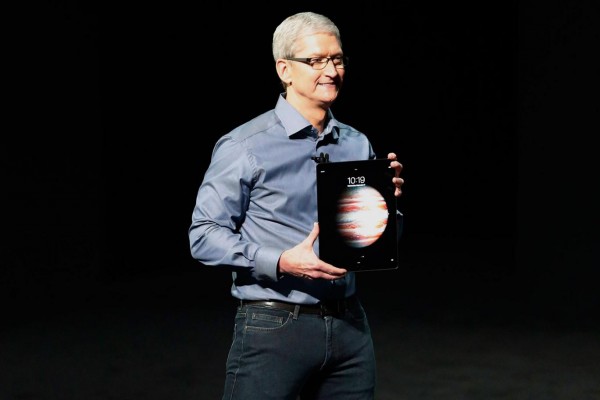

Third, Apple clearly recognizes that higher margins come from enterprise business in the long term, particularly as competitors attempt to compete with Apple in the phone and entry-level tablet space. One only needs to see the efforts being made by Amazon with its new tablet reported to be priced near $50 to see that price pressures will ultimately reduce margins. Apple’s partnership with IBMand now the introduction of the iPad Pro is obviously positioned as a way to capture higher margins through enterprise sales.

Here’s why enterprise matters for Apple: As the tech giant continues to grow, it needs to attack markets that can move the revenue needle. As Apple is just now getting started in the enterprise space, this is a growth opportunity for the company and I expect it will continue to be a focus.

Oh yes, Apple introduced a new iPhone and I’m sure the die-hard fan boys of the world will rush to consume any device Apple trots out. And yes, the Apple Watch now comes in different colors with different bands. These are interesting incremental changes but are not the key to Apple’s presentation this week.

What really matters for Apple long term is establishing runways for continuous upgrades of products in new spaces. That’s why these new products bear watching. For Tim Cook, it continues his push to expand Apple into new products and services. From the mythical Apple car to the new devices announced this week, he is moving in the direction of expanding Apple’s revenue base from iPhones and Macs into new product territories.

I don’t see any blockbusters here in the new product announcements. But I do see new opportunities for revenue growth and that reinforces my view that Apple stock is currently underpriced and an opportunity at current levels for a reasonable entry point.

Michael A. Yoshikami is the CEO and founder of Destination Wealth Management in Walnut Creek, California.

Disclosure: Michael Yoshikami does not own shares of Apple and has no other business relationship with the companies mentioned. But Destination Wealth Management may buy shares for clients.

Leave a Reply

You must be logged in to post a comment.