Lebanese ambitions to draw investors to its offshore reserve potential, notably for natural gas, brought in only two bids, the government reported.

Lebanon in January filed a request to join the Extractive Industries Transparency Initiative, a body that aims to cast light on how countries manage their oil, gas and mineral resources. Energy Minister Cesar Abi Khalil said that, as the country opens itself up to foreign energy investors, accountability was essential.

Decrees put forward by the Lebanese government outline a model for revenue sharing, something that derailed previous efforts to court foreign investors. The Lebanese government estimates there are 95 trillion cubic feet of natural gas and 750 million barrels of oil in its territorial waters.

Khalil said Thursday the government received two bids for offshore gas operations, but offered few specifics on the details, the English-language Daily Star reported.

“All that I can say now is that we received two bids and these bids will be evaluated by a special committee. Once the committee finalizes its evaluation and determines whether they meet the requirements then all the information will be revealed to the public,” he was quoted as saying by Lebanese media.

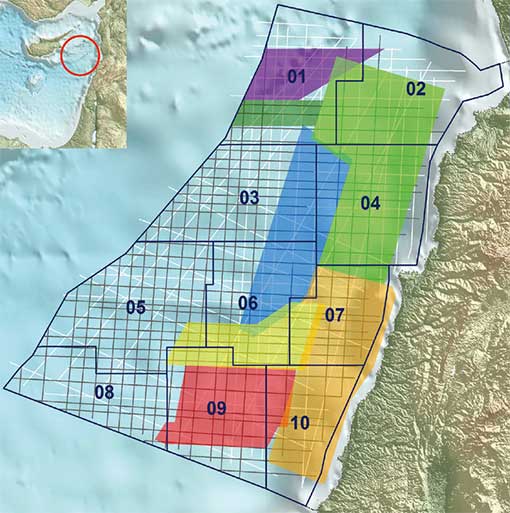

The blocks that were offered for bidding were 1,4,8,9 and 10 out of the 10 blocks that were surveyed by international firms to determine the potential size of hydrocarbon reserves.

According to the bidding conditions stipulated by the Lebanese Petroleum Administration, the international companies must form consortiums and each consortium would offer a bid to explore for gas in one of the five blocks that are up for grabs.

“Of course the nationalities of the companies that made the offers are Italian, French and Russian. I can’t say more than that. Once the committee finalizes its report Friday, I will disclose all the details,” Abi Khalil said.

According to the Energy Ministry, 51 companies have qualified to bid in the 2017 round.

The U.S. companies did not reportedly submit offerse ven though some of them had been among the first firms that had prequalified for bidding in 2013 including ExxonMobil and Chevron.

Many questions will probably be raised on why only 2 offers were made despite the fact that 51 qualified.

According to the minister it would take five to six years for the winning companies to start the actual extraction of gas off the Lebanese coast.

Lebanon has been at odds with Israel over maritime borders in the Mediterranean Sea. Parliament members from Shiite group Hezbollah have pushed for the development of offshore reserves. According to Israeli military leaders, Hezbollah’s military arm could hit emerging energy infrastructure centered on the port of Haifa with its missile arsenal.

Israel is working to exploit the gas reserves in the Leviathan and Tamar natural gas fields in the Mediterranean Sea. Delek Drilling, an Israeli company, estimates Leviathan, the larger of the two, holds about 21.4 trillion cubic feet of natural gas, an estimate that’s about 13 percent higher than when the field was discovered in 2010.

Beirut postponed offshore natural gas auctions several times after rancor erupted over the amount of revenue Beirut would get from energy companies.

UPI/ Agencies

Leave a Reply

You must be logged in to post a comment.