By: Mona Alami*

Relying on hundreds of millions of dollars stolen from Mosul banks and the control of oil and gas fields in Syria and Iraq, the Islamic State (IS) has touted its ambition to establish a caliphate stretching from Aleppo in Syria to Diyala in Iraq. But its financial assets may not be enough to meet the budgetary needs of its large military force and vast swaths of territory.

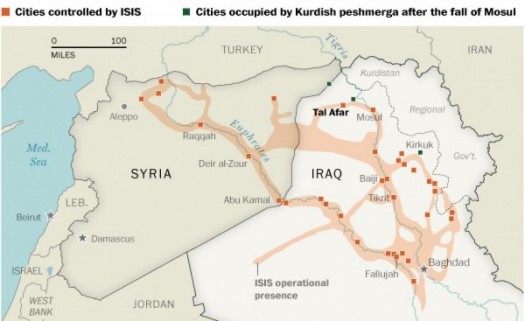

With an estimated military force of at least 50,000 fighters in Syria, IS already occupies territory from Aleppo, Raqqa, and Deir ez-Zor in Syria to the provinces of Salahuddin, Anbar, Nineveh, and Diyala in Iraq. Although IS leader Abu Bakr al-Baghdadi announced in his July speech the formation of a state that would return “rights and leadership” to Muslims, a steady income stream is needed to consolidate such a state. To that end, IS has set up tax collection mechanisms, participated in black market activities, and produced and sold oil and gas. But these measures will likely not be enough.

The Islamic State has been collecting eight million dollars a month from taxes in Mosul alone. Most of these “jihad taxes” are levied on companies and individuals, particularly religious minorities.1 For instance, road taxes of $200 on trucks were levied in northern Iraq to allow each of them safe passage. The militant group has looted banks—bringing in close to $400 million from the central bank of Mosul alone—and kidnapped foreigners for ransom. For instance, in the last six months, ten foreigners, including three French and two Spanish journalists held in Syria, were released by the group after the payment of a hefty ransom. An estimated twenty other foreigners are still held captive for ransom. Likewise, several groups of Turkish workers, a group of 40 Indian nurses, and a Chinese official have also just recently been released without ransom. Requested ransoms are typically about $100,000 but can be as much as $135 million, as was the case of American journalist James Foley.

While IS also receives donations from its backers in the Gulf and Europe, its seizure of oil fields has been its main source of income. The group already controls between 30 and 40 percent of the 100,000 oil barrels produced per day in Deir ez-Zor.2 They have also attempted to take over the Baiji refinery on August 24. Raad Alkadiri, managing director for the consulting firm IHS Energy, indicates that IS extracts an estimated 35,000 barrels per day in Iraq. From Syria and Iraq, the group sells a barrel of oil at prices ranging from $30 to $50, less than its market value so as to remain competitive. The oil is sold to middle men in Iraq, Turkey, Jordan, and Iran.

The Islamic State’s oil production methods are generally primitive, with production lower than pre-conflict levels in both countries. Most fields are older, meaning oil is harder to extract, requiring special expertise and technology that the group does not possess. Nonetheless, the Islamic State’s income from its share of Iraq’s oil market amounts to about $1 million a day. Together, Syrian and Iraqi oil generates a maximum of $3 million per day for the group, or about $1 billion per year.3

When including other illicit activities, its revenues total up to $1.4 to $1.5 billion per year. While this makes it the wealthiest extremist group in the world, it does not make its caliphate model economically viable in the long run. Administering the six provinces where it has majority control (Raqqa, Deir ez-Zor, Salahuddin, Diyala, Anbar, and Nineveh) requires enormous funds and the ability to deliver services to a large territory, home to eight million people (five million in Iraq and three million in Syria).

In areas under IS control, costly repairs and reconstruction efforts are required, including work on roads, electrical grids, schools, and hospitals. In Deir ez-Zor, a province home to 1.6 million people prior to the Syrian war, there were 27 hospitals and over 1,000 schools. Raqqa likewise housed about one million people with 13 hospitals and over 1,300 schools, but much of this infrastructure is now destroyed or inoperable.4 With similar population sizes, the Anbar and Diyala regions in Iraq would need comparable reconstruction efforts.

The reconstruction and repair needs aside, just the cost to run these areas seems to exceed the Islamic State’s income. For example, the official budget for Salahuddin province was $409 million this year, Anbar’s budget was $1.153 billion in 2010, Diyala’s budget in 2012 was $123 million, and Nineveh’s in 2013 was $840 million, totaling over $2.6 billion in Iraq alone. Although the budgetary needs in Syria are more difficult to estimate, as the provinces do not have independent budgets, the amount required would be sizable nonetheless. The Syrian government set an $8.18 billion fiscal budget in 2014 merely for areas under its control to cover food and fuel subsidies and public salaries, among other expenses. If IS seeks to finance its armed expansionist push, it would face a significant deficit, exclusive of reconstruction costs, applying past administrative budgets for these regions. With subsidies maintained, this deficit will be even greater. If IS prioritizes its expansion, this would come at the expense of existing administrative and military expenses for services in Iraq and Syria—and without such services the public backlash would be considerable.

The Islamic State cannot rule in the long run without governing, which requires building some semblance of infrastructure and ensuring a steady flow of services. Therefore disrupting IS’s access to money will be an effective way to weaken it, particularly targeting its oil smuggling and illicit trade networks in the region. Because even with its current financial assets and regional financiers, the Caliphate will not be economically sustainable.

*Mona Alami is a French Lebanese journalist. She writes about political and economic issues in the Arab world, namely in Jordan, Egypt, Lebanon, Syria, Sudan, and the UAE.

Carnegie Endowment

Leave a Reply

You must be logged in to post a comment.