Iran is suffering a new round of economic instability after the unexpected victory of moderate president-elect Hassan Rohani earlier this month.

Iran is suffering a new round of economic instability after the unexpected victory of moderate president-elect Hassan Rohani earlier this month.

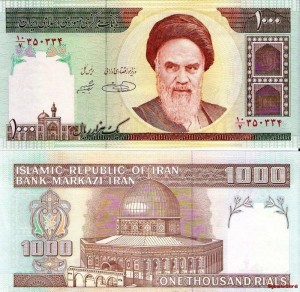

Although the national currency, the rial, has risen by 12 per cent since Mr Rohani’s win, prices have remained high as wholesalers insist the strengthening of the rial is temporary because sanctions on the country’s nuclear programme remain in place.

Markets for cars, home appliances, electronic equipment and housing have stagnated since June 14 as Iranians wait for the fall in the value of hard currencies to be translated into lower prices.

“People now suffer from a mirage of cheap prices and refuse to buy goods,” said Morad, a merchant of home appliances in Tehran’s grand bazaar. “But in fact nothing has changed and sanctions are still there.”

One US dollar bought 32,000 rials on Wednesday, down from 36,200 rials before the election.

The parity rate hit the lowest in nine months over the weekend but has gained again this week. The rial has lost about 50 per cent of its value since last year following US and European Union banking and oil sanctions over the nuclear programme. The sanctions have led to a dramatic fall in oil revenues – the country’s lifeline – and increasing difficulties in transferring hard currencies into the country.

Analysts argue that recent strengthening of the rial is a psychological reaction to the surprise victory of Mr Rohani, who promised to “save” the country’s economy through reconciliation with the world’s major powers over the nuclear dossier and help ease international sanctions.

Iran’s supreme leader and ultimate decision maker, Ayatollah Ali Khamenei, on Wednesday blamed the US for the nuclear stalemate.

“Resolving the nuclear issues is easy,” he said in a public meeting with judicial authorities, adding that the US and Israel were not willing to end the crisis. “The enemy’s goal is to exert more pressure, exhaust people and change the regime.”

Nonetheless, fluctuations in the currency market and an 8 per cent rise in the index of Tehran Stock Exchange over the past two weeks reflect Iranians’ expectation of fresh and more fruitful nuclear negotiations and some sanctions relief.

Many people who had converted their rial-based savings into US dollars and gold coins have started selling their valuables since the election to safeguard against losing the value of their assets in case of a nuclear deal.

Moussa-Reza Servati, a parliamentarian, estimated Iranians were hoarding hard currency and gold coins worth as much as $20bn, and said some of this had been sold since the election.

However, analysts argue that there is no basis for the fall in the value of hard currencies, as sanctions – which were the main reason behind the fall of the rial – remain in place and there is little change expected in the country’s economy before the outgoing president Mahmoud Ahmadi-Nejad leaves office in early August.

Hossein Abdeh-Tabrizi, former secretary-general of the Tehran Stock Exchange, warned that a further decrease in value of hard currencies could weaken domestic producers, who were hoping that expensive dollars would discourage imports and shift the country’s dependence to locally produced goods.

Reformist media have speculated that the strengthening of the rial is a deliberate move by the departing government – which is accused of leaving a legacy of economic ruin – to sabotage Mr Rohani’s rule.

Saeed Leylaz, a reform-minded economic analyst, claimed the government was cutting the exchange rate in order to reduce the government’s rial-based income and increase the debt burden facing Mr Rohani when he takes office.

Iran’s central bank governor, Mahmoud Bahmani, denied any such intervention in the currency market. But he said his bank would take “all necessary measures to support the declining trend in the value of hard currencies”.

Financial Times

Leave a Reply

You must be logged in to post a comment.