Many Venezuelans, mainly among the poor, are intensely mourning the passing Tuesday of President Hugo Chávez, whom they viewed as their “champion”, a father figure who after 14 years in power is taking on near saint-like meaning for them.

Many Venezuelans, mainly among the poor, are intensely mourning the passing Tuesday of President Hugo Chávez, whom they viewed as their “champion”, a father figure who after 14 years in power is taking on near saint-like meaning for them.

In their name, the charismatic Mr. Chávez implemented what he called “21-Century Socialism,” which in practice involved nationalization of broad swaths of the economy, especially in “strategic sectors” such as all the important oil industry — Venezuela sits atop the world’s largest oil deposits — telecommunications and power. He expropriated more than 1,000 businesses, sundry farmlands and urban properties, often without compensation, arguing that the seizures were justified either because the owners were in various ways corrupt or the seizures would improve the lots of the poor, usually both. In the process, he engaged in class warfare, demonizing the country’s middle- and upper classes as the “Squalid Ones.”

In his push to build a socialist system Mr. Chávez — who had Venezuela’s armed forces adopt the motto, “Country, Socialism or Death” — greatly ramped up government spending off the back of historically high oil revenues and a massive increase in national external debt, which went from around $28 billion during his first year in power to around $90 billion currently. Much spending has gone into subsidized food, housing, health, education and other welfare programs that have no doubt to varying degrees benefited the poor.

But a look at the available data — and it’s limited, as Venezuela hasn’t held an Article IV consultation with the International Monetary Fund in 87 months and has stopped reporting a number of standard indicators — the economy hasn’t exactly produced a socialist paradise.

Heavy government spending has fueled rampant inflation, which averaged an annual 22% during Mr. Chávez’s tenure. Its anticapitalist rhetoric and broad state intervention into the economy have led to a dearth of investment. Gross fixed capital formation declined to 18% of gross domestic product in 2011, from 24% in 1999, according to the World Bank. Net inflows of foreign direct investment stood at 2.9% of GDP during that same year, his first in office, nearly double the 1.7% in 2011. Capital flight from Venezuela intensified as Mr. Chávez pursued more interventionist policies, including capital controls and a fixed official exchange rate that — if you can get it — offers dollars at a quarter of the exchange rate that the greenback fetches in the black market. Stock market capitalization of companies listed on the Caracas Stock Exchange has gone from a paltry 7.6% of GDP in 1999 to a minuscule 1.6%.

Rather than pursue policies that might stimulate investment, the government’s response to shrinking productive capacity and high inflation has been price caps. The result? Shortages of food and other basic necessities, periodic electric brown- and blackouts, and far fewer jobs: the labor force participation rate has dropped from 52% to 46% in the Chávez era.

In countries less blessed with natural resources, Mr. Chávez might have been forced to be more welcoming of private-sector investment. But Venezuela’s oil bounty permitted his pursuit of highly unorthodox policies and inefficient use of resources. Yet not without cost to its oil industry.

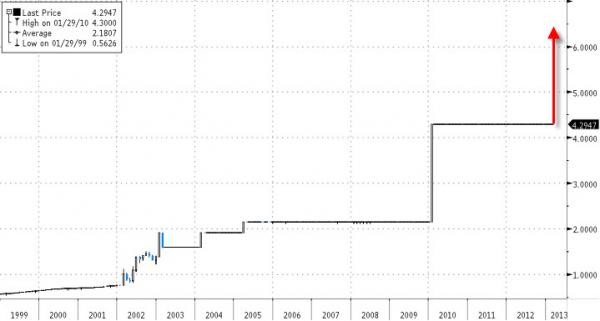

Venezuela’s oil production has fallen to around 2.5 million barrels a day from about 3.2 million, according to most industry estimates. Downstream refinery accidents have increased sharply amid a lack of investment and upkeep, with one last year at the Amuay complex proving among the most deadly the energy industry has seen. Energy-rich Venezuela has since been importing more fuels. Still, prices for the country’s crude have risen about 10-fold during Mr. Chávez’s time in office, enabling him to borrow and spend aggressively.

That has helped the economy grow, albeit at a lackluster annual average of 3% since 1999. GDP per capita rose to an estimated $11,131 last year, from $4,132 in 1999, according to the IMF, but there are no data available on income distribution, which by all accounts still displays high disparities among the population. Venezuela is also now far more dependent on oil revenues that it was when Chávez first took office: Oil now accounts for about 95% of all exports, compared to about 80% in 1999, and represents nearly two-thirds of fiscal revenue, versus about half 14 years ago.

It’s well known that inflation and basic necessity shortages hit the poor the hardest, as does crime, which has skyrocketed in Venezuela. According to InSight Crime, an American University-sponsored think tank in Washington DC, the country has seen a sharp rise in violence, “with murder rates doubling or tripling over a decade, according to different figures.” For the first time in several years, the government reported homicide data, noting over 16,000 murders last year. But the Venezuelan Observatory of Violence, a local non-government organization that tracks crime, put the number at nearly 21,700, for a national homicide rate of 73 per 100,000, more than double the 31 per 100,000 in Colombia, which is fighting two guerilla insurgencies.

It remains to be seen whether the next government will be able to manage the economic distortions and social problems that continue to plague Venezuelans. Snap elections must be called within a month, Mr. Chávez’s vice president, Nicolás Maduro, is expected to win.

“Vice-President Maduro is perceived as close to the Cuban regime and committed to the revolutionary ideals spearheaded by President Chávez,” wrote Goldman Sachs economist Alberto Ramos in a research note. “However, like virtually every other senior figure of Chavismo, Mr. Maduro lacks the charisma and broad popular support enjoyed by President Chávez.”

Mr. Maduro has vowed to maintain the “revolutionary” policies of Mr. Chávez. Given the many economic and social challenges facing Venezuela’s poor, it remains to be seen whether populism alone will, from now on, be enough.

WSJ

Leave a Reply

You must be logged in to post a comment.