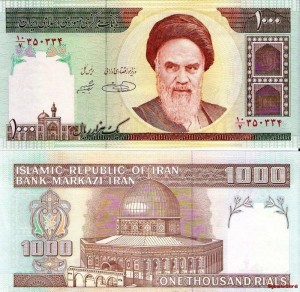

Iran’s rial plunged at least 9 percent to a record low against the U.S. dollar on Tuesday as the industry minister said he hoped security services would root out speculators whom he blamed for the drop.

Iran’s rial plunged at least 9 percent to a record low against the U.S. dollar on Tuesday as the industry minister said he hoped security services would root out speculators whom he blamed for the drop.

The rial was trading at about 37,500 to the dollar, down from around 34,200 at the close of business on Monday, a foreign exchange trader in Tehran told Reuters. Other Tehran traders said the rial had dropped even further, to 38,000 or 40,000.

The currency has lost about a third of its value since Monday last week, when the government launched an “exchange centre” that was designed to stabilise the rial by supplying dollars to importers, but appears to have backfired.

Iran’s economy has been hit hard this year by Western economic sanctions against its disputed nuclear programme. The sanctions have slashed its oil exports and mostly excluded it from the global banking system.

Iranians have responded by scrambling to change their rial savings into hard currency, fuelling the slide.

“We have greater expectations that the security services will control the branches and sources of disruption in the exchange market,” said Iran’s minister of industry, mines and trade Mehdi Ghazanfari, according to the Fars news agency.

“Brokers in the market are also pursuing the increase in price because for them it will be profitable, and there is nobody to control them.”

Reuters

Leave a Reply

You must be logged in to post a comment.