Lebanese authorities said on Monday the country’s financial institutions could cope with the prime minister’s surprise resignation at the weekend and the stability of the Lebanese pound was not at risk.

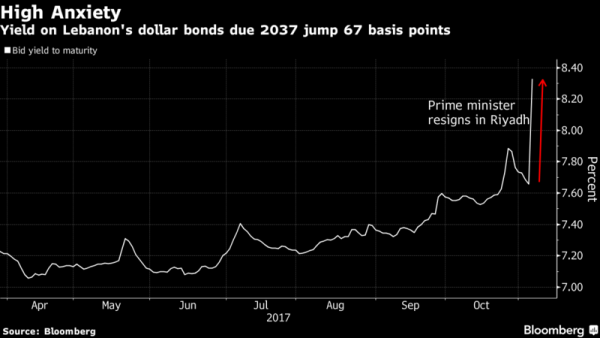

But two days after Prime Minister Saad al-Hariri resigned in a broadcast from Saudi Arabia, the cash price of Lebanon’s U.S. dollar-denominated bonds fell, with longer-dated maturities suffering hefty losses as investors took a dim view of the medium- to longer-term outlook for Lebanon.

Finance Minister Ali Hassan Khalil said Lebanon and its financial institutions could absorb the impact of Hariri’s resignation and the state is able to finance itself.

“We are confident in the stability of the financial and monetary situation in the country. There are no very big challenges ahead of us,” Khalil said in a televised statement after a meeting on the economy chaired by President Michel Aoun.

Lebanon’s central bank has to maintain adequate foreign reserves to keep the currency pegged at 1,507.5 Lebanese pounds to the dollar.

With revenues and growth low, the country relies for those foreign reserves on deposits made in local banks by millions of expatriate Lebanese. The banks buy government debt, which finances an expanding budget deficit and debt.

Central Bank Governor Riad Salameh on Monday told local TV channel LBC the pound was not in danger, Lebanon’s monetary situation was stable and markets were normal.

Salameh told Reuters on Oct. 25 central bank reserves were at a record high of $44.3 billion.

“The Lebanese pound remained stable through more critical turmoils in the past, such as the assassination of (former Prime Minister) Rafiq Hariri in 2005 and the war with Israel in July 2006,” Garbis Iradian, chief Middle East and North Africa economist for the Institute of International Finance told Reuters.

Byblos Bank Chief Economist Nassib Ghobril told Reuters he thought the pound would remain stable because of the central bank’s policies and foreign currency assets.

MARKET REACTION

On Monday Lebanon’s dollar-denominated bonds fell across the curve. The issue maturing in 2037 LB158623030= chalked up the biggest declines, dropping 5.45 cents to trade at 90.55 cents in the dollar.

On Monday Lebanon’s dollar-denominated bonds fell across the curve. The issue maturing in 2037 LB158623030= chalked up the biggest declines, dropping 5.45 cents to trade at 90.55 cents in the dollar.

Other issues, such as the bond maturing in 2027 LB085936689=, lost more than 4 cents to trade at their lowest level since June 2013.

“The Middle East jumped a big step in volatility” with Hariri’s resignation, said Simon Quijano-Evans, emerging markets strategist at Legal & General Investment Management.

That resignation again exposed Lebanon to the sharp end of the rivalry for Middle East predominance between Sunni Muslim Saudi Arabia and Shi‘ite Muslim Iran.

“Lebanon is yet again caught in between and, given the delicate political situation at home, remains very vulnerable to any outside influence,” Quijano-Evans said.

Finance Minister Khalil told Reuters the fall in bond prices was a natural reaction to events and no cause for concern.

The cost of insuring exposure to Lebanese debt hit its highest since early January, with Lebanon five-year credit default swaps LBGV5YUSAC=MG 10 basis points to 479 bps from Friday’s close, according to HIS Markit.

On the JPMorgan EMBI Global Diversified index of sovereign dollar bonds from developing countries, the premium that investors demand to hold Lebanese debt .JPMEGDLEBR over U.S. Treasuries jumped by 62 bps from Friday’s close to 530 bps – the biggest gap since July 2016 and well above levels for Iraq, which stood at 460 bps.

Trading on the Beirut Stock Exchange, where volumes are usually low, was muted on Monday with prices down.

Lebanese property developer Solidere’s share price fell 7.6 percent. Solidere is one of only 10 companies listed on the exchange and its share price is seen as a bellwether of sentiment and political events in Lebanon.

GROWTH OUTLOOK

Lebanon’s economy has been battered by six years of war in neighboring Syria and by simmering political divisions, which came to the fore with Hariri’s resignation.

Growth has slowed to just over 1 percent a year from an average of 8 percent before the Syrian conflict began in 2011. Lebanon also has one of the world’s highest ratios of debt to gross domestic product, around 140 percent.

Lebanon ended a two-and-a-half year political vacuum at the end of last year with the President Aoun’s appointment and the formation of a new government under Hariri. It was hoped the new government would boost confidence and enact badly needed reforms to support growth.

The Institute of International Finance said although the impact of Hariri’s resignation on the economy would be limited, it would lower its forecast for Lebanon’s growth rate for 2017 to 2.2 percent from 2.4 percent and for 2018 to 1.8 percent from 2.9 percent, assuming a new consensus government will not be formed in the next six months.

The central bank had estimated a growth rate of 2.5 percent for 2017.

REUTERS

Leave a Reply

You must be logged in to post a comment.