By Ghassan Karam, Special To Ya Libnan

“Don’t look a gift horse in the mouth” is a proverb that is obviously worthy of emulating in life especially when personal gifts are given on personal occasions. One must enjoy the gift instead of examining its value. But under some circumstances it is important to be grateful for the gift but it is equally important to understand the exact characteristics of the gift in question so as not to have excessive expectations. A good example of the latter is the buzz about natural gas fields off shore.

Nabih Beri has unleashed on the unsuspecting Lebanese public very few facts about the potential for a natural gas find of f Lebanon that have accomplished nothing but to paint a wrong image and wrong expectations about this issue. The newspaper Al Safir also heightened the public anxiety by hinting at the possibility that Israel might be siphoning off natural gas deposits that lie in Lebanese territorial waters.

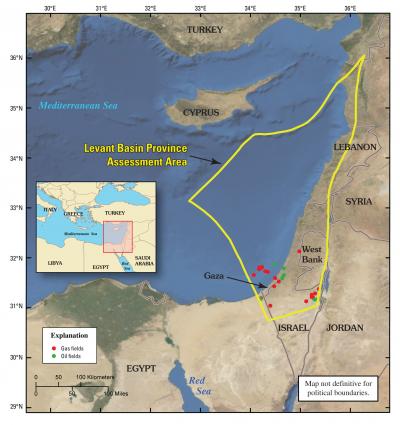

The United States Geological Society, USGS, conducts global studies about the potential size of deposits in order to help countries plan for the future. In a recent study, released in early April 2010 the USGS revealed that their estimate for the natural gas potential of the Levant field has a mean of 120 trillion cubic feet. Note from the above graphic that the Levant is a huge area of over 83,000 square kilometers; almost 8 times the area of Lebanon; opposite the coast of Syria Lebanon and Israel. The greater area of the reservoir appears to be in the southern end, opposite the Israeli cost.

The USGS claims that these reserves are exploitable under the current pricing structure and the present technology but this does not mean that gas is found in equal quantities and concentrations all throughout this vast area. Many studies and exploratory wells need to be performed.

Natural gas is sold for its energy content. It is estimated that on the average each 1000cubic feet have 1,000,000 BTU and each of these 1000 cf sells on the future exchange for under $5.00 Natural gas contracts represent 10 billion BTU’s and so each contract has an approximate value of $50,000.00. Given the above then you should be able to arrive at an approximate PV of the natural gas in question. An example might help: Israel estimates its natural gas find off Haifa at 16 tcf which translates into $80 billion over about 50 years. Once one accounts for the cost of exploration and refinery the annual revenue is most likely to be $700-800 million per annum.

Lebanon has not yet awarded any exploration rights within its territorial water and so it is premature to make any estimates regarding the amount of reserves found and at what depth. But it would be helpful to take a stab at the potential windfall if all of this is to be realized. Assuming that the proportion of the Levant that belongs to Lebanon is 40% and assuming that this Lebanese portion contains 40 % of the natural gas then its current gross market value is about $240 billion over 50-60 years. If the marketing, refining administrative and exploration costs are to amount to say 30 % of the revenue then the annual revenue would be around $2-2.5 billion per annum.

No one would dismiss the power of such a stream of revenue especially if the funds are handled responsibly. Yet it ought to be highlighted that Lebanon has been in essence foregoing an annual income equivalent to that which might ultimately be achieved from the off shore natural gas fields by continuing to make a mockery of its electric utility whose annual deficit amounts to $1.5 billion when it could easily generate profits of that amount. And the biggest of all ironies is that the modernization of electric power does not act as a drag on the budget since all its investments should be self financing.

In conclusion, it sure would be helpful to the Lebanese economy to have a substantial stream of reliable income but even if that does not happen we have many other areas that are crying for reform so that they can make a positive contribution to Lebanese welfare.

Note: The USGS estimates also that the Levant has about 1.7 billion barrels of oil.

Leave a Reply

You must be logged in to post a comment.