The Central Bank of Lebanon announced Wednesday that it will end subsidies and will begin securing the necessary credits for fuel imports based on the market price of the Lebanese pound against the US dollar.

In a statement that, the central bank said that starting tomorrow, Thursday, “the Central Bank of Lebanon will ensure the necessary funds relating to fuel, adopting the same previous mechanism, but calculating the price of the dollar on the Lebanese pound according to market prices”, meaning the black market

Since the beginning of the financial crisis in Lebanon, the central bank used its dollar reserves to finance fuel imports at official exchange rates that are well below the parallel market exchange rate for the dollar.

Lebanon is suffering from severe fuel shortages due to a financial crisis that has caused the Lebanese pound to lose more than 90% of its value against the dollar in less than two years.

A ministerial source and a report by Al-Jadeed TV said Lebanon’s central bank governor Riad Salameh said Wednesday that the central bank can no longer open credit lines for fuel imports.

Reuters has not yet been able to reach Salameh for comment on his comments at a Supreme Defense Council meeting.

The government raised fuel prices in June after the central bank began offering fuel lines of credit at £ 3,900 per dollar, above the official rate of £ 1,500 but still far below the market rate. parallel.

The dollar is at 20,500 pounds

The dollar traded at around 20,500 LL in the black market on Wednesday.

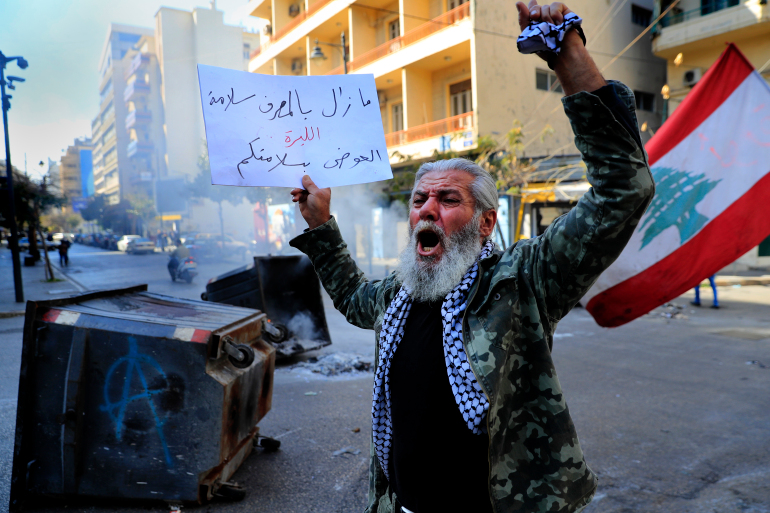

Lebanon is facing an economic collapse that threatens its stability. The country has almost lost its foreign exchange reserves and the shortage of basic necessities such as fuel and medicines has worsened.

It also suffers from severe electricity and water shortages after running out of fuel in two of the country’s main power plants, in the latest manifestation of the financial crisis that shows no signs of ending.

20 Liters of medium octane gasoline cost around 25, 000 LL in October 2019 . That was when the Dollar was worth 1500 LL approximately . This same amount of gas will cost at least 375,000 LL once subsidy is removed or 15 times more .

Many analyst predict that if PM designate Najib Mikati , quits the task of forming a government anytime soon , the dollar will immediately shoot to 30, 000 LL to the dollar and nothing will be able to stop the complete collapse of the Lebanese Lira

Such a move will be catastrophic for Lebanon … it will mean no , no water , no bread and no transportation of any kind and it means that bakeries have to shut down because they all use fuel for baking and the hospitals have to shut down because they cannot operate their equipment and receive any more patients.

This should not have ever happened according to analysts who claim that most of the subsidized fuel that Lebanon used to import ended up in Syria

Former Hezbollah chief Sheikh Sobhi el Tufaili accuses Hezbollah of robbing the countryAccording to analysts , Hezbollah controls all the border points of Lebanon , both legal and illegal and shipped most of the subsidized products , not only the fuel but the medicines and wheat flour to Syria and made billions of dollars in profit at the expense of the Lebanese people.

What happens next in Lebanon is anybody’s guess one analyst told Ya Libnan , only a miracle can save the country

YL with Agencies

Leave a Reply

You must be logged in to post a comment.