Defaulted Lebanon gave the first glimpse of its restructuring plans by setting a goal of halving one of the world’s biggest debt burdens as early as this year and moving to a more flexible exchange rate, according to a draft document seen by Bloomberg.

The government is discussing a reform plan submitted by the Finance Ministry and drafted by a group of advisers including other ministries and Lazard Ltd. While it could pave the way for unlocking billions in promised aid, the success of the proposed reforms largely depends on the support from the International Monetary Fund, according to the plan.

Bringing Down Debt

Lebanon expects to almost halve its debt ratio this year

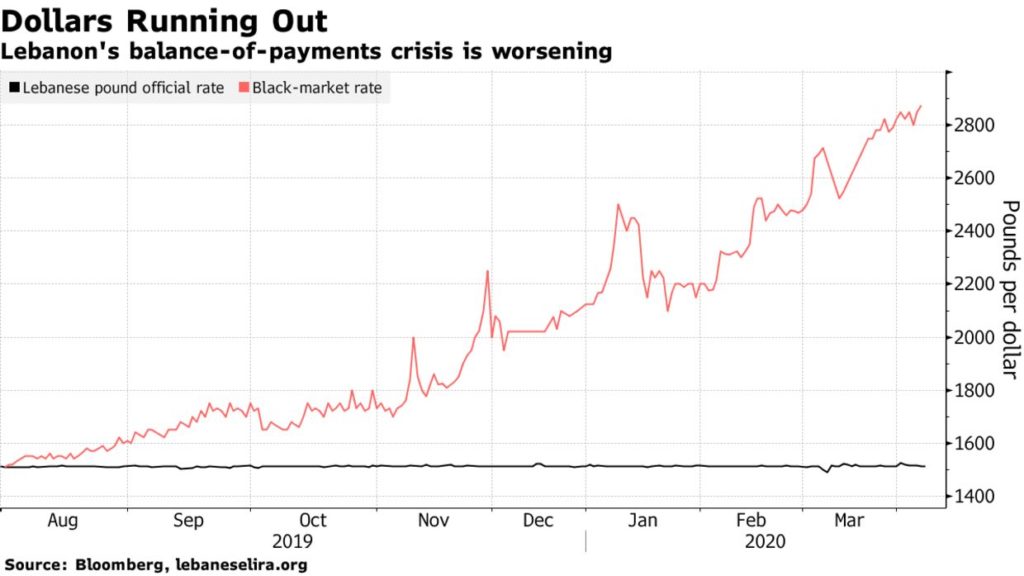

Faced with its worst financial crisis since the civil war ended in 1990, Lebanon is struggling to keep its finances afloat. A severe dollar shortage and a drop in foreign-exchange reserves to critical low levels have driven the economy to the brink of collapse following years of mismanagement and corruption.

Lebanon last month defaulted on a Eurobond for the first time in its history and then set about trying to overhaul its entire debt stock of $90 billion and engage in talks with bondholders, mainly local banks. Successive governments have repeatedly failed to implement the deep reforms needed to boost growth, reduce the budget deficit and fix the ailing power sector in return for financial aid.

Lebanon instead kept up its borrowing, relying on remittances from the millions of Lebanese living abroad as its main source of financing. As inflows started to dry up over the past year, cracks in the funding model began to show and eventually wreaked havoc in banks and the import-reliant economy.

The plan, described as “Made in Lebanon,” sets out a five-year road-map to boost growth to 2% by 2024. The economy is currently in recession, with gross domestic product expected to shrink 12% this year.

The government forecasts its debt burden will drop to 92% of GDP this year. Officials expect a restructuring to be finalized by the end of 2020.

Some highlights from the plan:

- Lebanon targets the ratio of debt to GDP steadily declining from its current 176% to 103.1% by 2024 and further to 90.2% by 2027; the budget deficit would narrow from this year’s 7.2% of economic output to 1.3% in 2024.

The document outlines a gradual change in the currency peg starting in 2021 in which it would weaken to 2,607 per dollar, compared with the decades-old fixed-exchange regime of 1,507.5. It’s ultimately expected reach nearly 3,000 by 2024. The black-market rate is currently at 2,800 and under pressure to rise higher- The government plans to eliminate electricity subsidies as soon as power is provided 24 hours per day. Tariffs will increase gradually with the generation supply.

The government would need external financing of $10 billion to $15 billionover five years, preferably through a loan program with the IMF, according to the document. Back in January, the Institute of International Finance estimated Lebanon’s external funding needs at about $24 billion over 2020-2024.

Under the plan, outside assistance would be complemented by savings from the government’s debt restructuring plan and a return to international markets in three years. Lebanon also seeks to roll over domestic debt, mostly held by the central bank, at reduced rates.

Securing a five-year grace period on payments of principal and a coupon reduction to a minimum level during that same period would generate an additional $15 billion to $18 billion of the projected $30 billion balance-of-payment requirements, according to the plan.

The central bank, also known as Banque du Liban, has incurred losses of more than $40 billion, mainly due to the so-called financial engineering operations it began conducting in 2016 and which boosted its reserves.

Almost half of Lebanon’s bank assets are parked at the BdL and losses on them could reach around $62.2 billion, according to preliminary estimates outlined in the document.

The draft plan envisages a full bail-in of existing shareholders at banks. The balance of losses would be covered by a “transitory exceptional contribution from large depositors,” guaranteeing that the assets of 90% of clients would be preserved.

The central bank last week instructed local banks to pay customers with deposits of up to $3,000 in Lebanese pounds at market level, a move to help small holders exit the system and most likely avert a haircut.

The plan also sees the government establishing a special fund to compensate depositor losses that result from the overall restructuring.

BLOOMBERG

Leave a Reply

You must be logged in to post a comment.