Read more here: https://www.newsobserver.com/news/business/article240257311.html#storylink=cpy

BY SARAH EL DEEB ASSOCIATED PRESS

Lebanon’s finance minister said Thursday the country’s new government is weighing whether to pay or default on its $1.2 billion Eurobond debt, which matures next month, amid an economic crisis that has sparked months of unrest.

Lebanon is grappling with its worst financial crisis since the end of the 1975-1990 civil war, including a deepening liquidity crunch and a soaring public debt. Meanwhile, anti-government protests have targeted the country’s ruling elite, faulting them for widespread corruption and the failing economy.

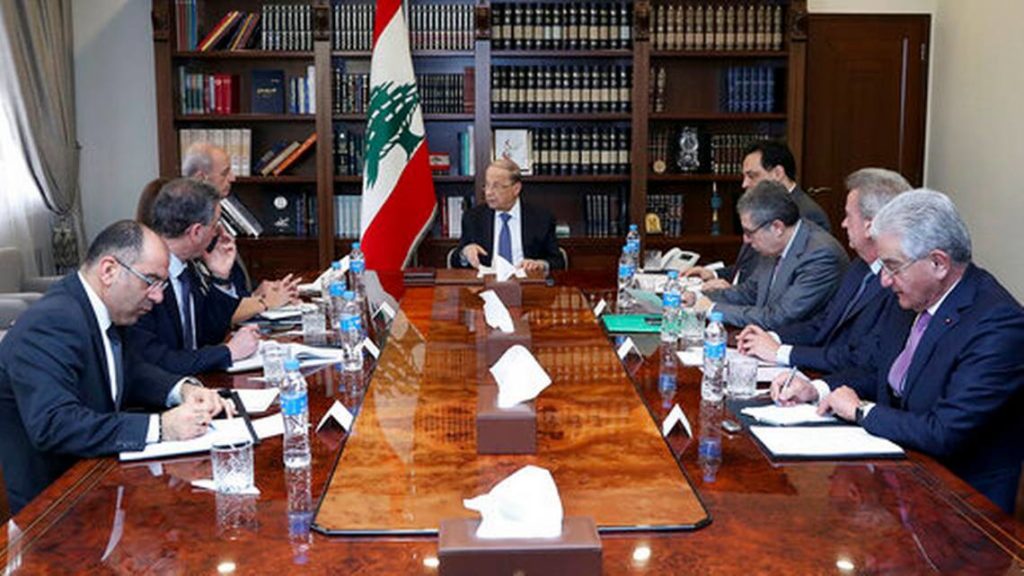

“It is not easy,” finance minister Ghazi Wazni told reporters before the new Cabinet’s first meeting. He spoke after reviewing different options with the government’s financial team.

Lebanese banks raised interests rates in a bid to attract foreign investments, but now the influx of foreign currencies has dried up and the central bank’s foreign currency reserves are shrinking.

“This is an important decision for the country, depositors, banks, the economic sector and international institutions,” Wazni said, adding that the search for the “right decision” was ongoing.

Also on Thursday, Lebanon’s central bank lowered interest rates on bank deposits of dollars and Lebanese pounds. It put caps of 2% and 4%, respectively, on one-month dollar deposits and dollar deposits of one year and above.

The bank capped Lebanese pound deposits at between 5.5% and 7.5%.

This marked the second time in two months the central bank lowered interest rates in Lebanon, which were as high as 8% and 12% on the dollar before, aimed at addressing the liquidity problem.

The new government, headed by Prime Minister Hassan Diab, was voted into office earlier this week by Parliament and is facing snowballing political and economic crises. Diab appealed to the international community and political opponents to give his government a chance.

On Wednesday, the International Monetary Fund said Lebanese authorities had requested its technical advice on macroeconomic issues facing the country.

Read more here: https://www.newsobserver.com/news/business/article240257311.html#storylink=cpy

“IMF stands ready to assist Lebanon,” Gerry Rice, IMF spokesman tweeted Wednesday. “Any decisions on debt are the authorities’, to be made in consultation with their own legal and financial advisers.”

The government said it was consulting experts to make appropriate decisions before the end of February, said Minister of Information Manal Abdel Samad after the first Cabinet meeting Thursday.

The most immediate question was what to do about a $1.2 billion Eurobond that matures on March 9: Default or pay.

Lebanon has never defaulted on its debt payments. Defaulting could be costly to the national economy and banking system, which until the recent financial crisis was one of Lebanon’s most profitable and reputable sectors.

The government is likely to explore restructuring options but it would require an economic plan supported by the IMF and a domestic consensus.

Lebanon’s fractious politics, rising popular dissent and the deepening financial crisis are likely to make it difficult for the current government to make difficult decisions. And while the new prime minister may be willing to take bold steps, the central bank governor is likely to opt for more prudent measures, Ayham Kamel of the political risk consultancy Eurasia Group wrote in a brief Thursday.

“Supporters of the new government do not want it to be held responsible for the political fallout (of not paying) and would rather direct it towards the IMF,” he said.

Meanwhile, public opinion was building against repayment as many argue the priority should be to use shrinking foreign currency to pay for imports of basic needs.

Banks have already imposed informal capital controls on depositors, limiting their withdrawals of foreign and local currencies as well as transfers abroad. The limits have prompted protests against the financial institutions — including violent attacks on ATM machines and some bank branches. Security has been beefed up around banks while some branches have shut down their offices.

Wazni said the government is working to streamline capital controls imposed selectively by commercial banks.

“The banks can’t deal with the depositors in an illegal and unclear way,” he said without elaborating.

Lebanon’s international backers have called on the government to institute swift and comprehensive reforms.

“This is an important decision for the country, depositors, banks, the economic sector and international institutions,” Wazni said, adding that the search for the “right decision” was ongoing.

Also on Thursday, Lebanon’s central bank lowered interest rates on bank deposits of dollars and Lebanese pounds. It put caps of 2% and 4%, respectively, on one-month dollar deposits and dollar deposits of one year and above.

Read more here: https://www.newsobserver.com/news/business/article240257311.html#storylink=cpy

The bank capped Lebanese pound deposits at between 5.5% and 7.5%.

This marked the second time in two months the central bank lowered interest rates in Lebanon, which were as high as 8% and 12% on the dollar before, aimed at addressing the liquidity problem.

The new government, headed by Prime Minister Hassan Diab, was voted into office earlier this week by Parliament and is facing snowballing political and economic crises. Diab appealed to the international community and political opponents to give his government a chance.

ASSOCIATED PRESS

Leave a Reply

You must be logged in to post a comment.