By: Tom Perry, Jonathan Spicer

Lebanese Prime Minister Saad al-Hariri said on Tuesday the United Arab Emirates has promised investments and financial aid to his deeply indebted country, though work remains to seal the deal, after two days of high-stakes talks in Abu Dhabi.

Hariri, who led a Lebanese delegation to the allied Gulf state, was seeking funds to stem a sharp loss of investor and depositor confidence that has pressured Lebanon’s currency and strained its lenders and central bank.

While the UAE had made no announcement about funding by Tuesday evening, any sort of relief could buy Beirut time as it looks to shore up dollar reserves and begin enacting fiscal reforms it has long promised with little progress.

“The Emiratis promised investments and financial assistance,” he was quoted as saying in an official transcript of his comments to reporters in Abu Dhabi.

While the talks with the Emiratis were positive, Beirut “has to do some things to encourage them” to invest in Lebanon, Hariri added, without providing details.

“We are negotiating with them the investments they want to make in various sectors, in addition to financial investments in some banks or in the central bank,” he was quoted as saying in the transcript published by his office.

Faced with one of the world’s highest debt burdens, low growth and crumbling infrastructure, Beirut has vowed to implement long-delayed reforms to narrow its budget and current-account deficits, though little has so far been done.

The country, which has a debt-to-GDP ratio around 150%, is also seeking to reverse a sharp loss of confidence in the Lebanese pound. Its central bank has been drawing down its foreign exchange reserves to repay the state’s maturing debt, and has promised to do more.

“POSITIVE RESULTS”

Hariri had hoped on Monday for a cash injection into Lebanon’s central bank. But on Tuesday broadcaster MTV quoted him saying this option “requires study” and that discussions on the topic included risks to the UAE of such a move.

On Twitter, Hariri said “work is ongoing to receive” the promised funds, adding: “We have to follow up on the positive results of the visit and focus on the best investment the UAE can make in Lebanon.”

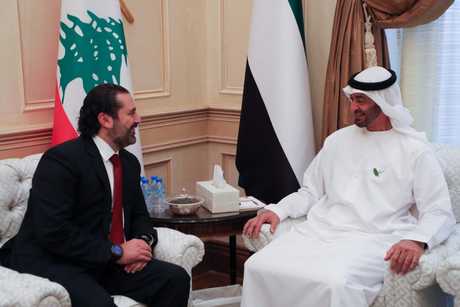

There have been no further official UAE statements on Hariri’s visit since his meeting with Abu Dhabi Crown Prince Sheikh Mohammed bin Zayed al-Nahyan on Monday, when the UAE lifted a ban on its citizens traveling to Lebanon.

A significant UAE investment in Lebanon would mark a new phase in relations.

For the UAE, the benefits could include building political sway to counter the powerful Iran-backed Shi’ite Lebanese group Hezbollah while also the chance to invest in Lebanon’s nascent oil and gas sector or its port.

“The UAE’s position makes sense: they want assets, not paper. The problem is that real investments take time to materialize and the disbursements are (slow),” said Carlos Abadi, managing director at financial advisory firm DecisionBoundaries in New York.

“I think that Hariri was pining for a $3-5 billion Emirati deposit into the central bank as a way to buy political breathing room to enact the reforms,” he added.

REUTERS

Leave a Reply

You must be logged in to post a comment.