BEIRUT (Bloomberg) — Lebanon approved two measures allowing it to auction its first offshore oil and natural gas rights, ending three years of delays that kept the tiny country from joining a regional race to tap energy wealth in the eastern Mediterranean.

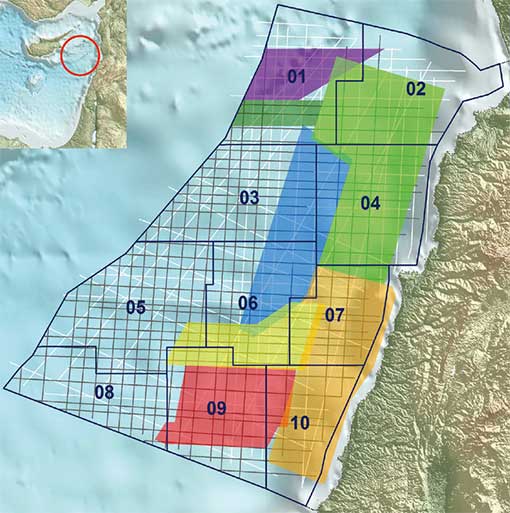

The newly formed government headed by Prime Minister Saad Hariri passed the two decrees on Wednesday, state-run National News Agency reported, citing Foreign Affairs Minister Gebran Bassil. The decrees demarcate energy blocks, establish production-sharing contracts and specify tender protocols. They take effect with no need for additional approval.

The cabinet formed ministerial committees to study a petroleum tax draft law and another proposed law governing onshore oil resources, Information Minister Melhem Riachi said in a televised news conference. The cabinet also discussed the establishment of a sovereign wealth fund to manage the oil and gas revenue.

Lebanon has lagged behind neighboring Israel, Cyprus and Egypt in developing oil and gas deposits that may lie beneath its share of the Mediterranean Sea. Seismic surveys show the country could hold at least 96 trillion cubic feet of gas and 850 MMbbl of oil, Bassil, who was then the country’s energy minister, said in a December 2013 interview. Exxon Mobil Corp. and Eni SpA are among companies qualified to bid to explore off the country’s coast.

Cash needs

An auction of energy assets first scheduled for November 2013 was delayed after the government failed to pass the decrees. Political disputes then left the country without a president for more than two years until the Oct. 31 election of Michel Aoun, a Christian close ally of the Iran-backed Hezbollah group. Lebanon, which is struggling with severe power shortages and hosting more than a million Syrian and Palestinian refugees, needs revenue to trim its public debt, the highest as a share of annual economic output among Arab states.

Exxon Mobil, Eni, Chevron Corp., Petroleo Brasileiro SA and Royal Dutch Shell Plc are among companies qualified to bid as operators. Thirty-four companies qualified as non-operators, including Marathon Oil Corp., OMV AG and Dana Petroleum Plc.

Under Lebanese law, the government should start auctioning exploration rights six months after the date of the decrees.

WORLD OIL

Leave a Reply

You must be logged in to post a comment.