By Nassim Nicholas Taleb and Gregory F. Treverton

Even as protests spread across the Middle East in early 2011, the regime of Bashar al-Assad in Syria appeared immune from the upheaval. Assad had ruled comfortably for over a decade, having replaced his father, Hafez, who himself had held power for the previous three decades. Many pundits argued that Syria’s sturdy police state, which exercised tight control over the country’s people and economy, would survive the Arab Spring undisturbed. Compared with its neighbor Lebanon, Syria looked positively stable. Civil war had torn through Lebanon throughout much of the 1970s and 1980s, and the assassination of former Prime Minister Rafiq Hariri in 2005 had plunged the country into yet more chaos.

But appearances were deceiving: today, Syria is in a shambles, with the regime fighting for its very survival, whereas Lebanon has withstood the influx of Syrian refugees and the other considerable pressures of the civil war next door. Surprising as it may seem, the per capita death rate from violence in Lebanon in 2013 was lower than that in Washington, D.C. That same year, the body count of the Syrian conflict surpassed 100,000.

Surprising as it may seem, the per capita death rate from violence in Lebanon in 2013 was lower than that in Washington, D.C. That same year, the body count of the Syrian conflict surpassed 100,000.

Why has seemingly stable Syria turned out to be the fragile regime, whereas always-in-turmoil Lebanon has so far proved robust? The answer is that prior to its civil war, Syria was exhibiting only pseudo-stability, its calm façade concealing deep structural vulnerabilities. Lebanon’s chaos, paradoxically, signaled strength. Fifteen years of civil war had served to decentralize the state and bring about a more balanced sectarian power-sharing structure. Along with Lebanon’s small size as an administrative unit, these factors added to its durability. So did the country’s free-market economy. In Syria, the ruling Baath Party sought to control economic variability, replacing the lively chaos of the ancestral souk with the top-down, Soviet-style structure of the office building. This rigidity made Syria (and the other Baathist state, Iraq) much more vulnerable to disruption than Lebanon.

But Syria’s biggest vulnerability was that it had no recent record of recovering from turmoil. Countries that have survived past bouts of chaos tend to be vaccinated against future ones. Thus, the best indicator of a country’s future stability is not past stability but moderate volatility in the relatively recent past. As one of us, Nassim Nicholas Taleb, wrote in the 2007 book The Black Swan, “Dictatorships that do not appear volatile, like, say, Syria or Saudi Arabia, face a larger risk of chaos than, say, Italy, as the latter has been in a state of continual political turmoil since the second [world] war.”

The divergent tales of Syria and Lebanon demonstrate that the best early warning signs of instability are found not in historical data but in underlying structural properties. Past experience can be extremely effective when it comes to detecting risks of cancer, crime, and earthquakes. But it is a bad bellwether of complex political and economic events, particularly so-called tail risks—events, such as coups and financial crises, that are highly unlikely but enormously consequential. For those, the evidence of risk comes too late to do anything about it, and a more sophisticated approach is required.

Thus, instead of trying in vain to predict such “Black Swan” events, it’s much more fruitful to focus on how systems can handle disorder—in other words, to study how fragile they are. Although one cannot predict what events will befall a country, one can predict how events will affect a country. Some political systems can sustain an extraordinary amount of stress, while others fall apart at the onset of the slightest trouble. The good news is that it’s possible to tell which are which by relying on the theory of fragility.

Simply put, fragility is aversion to disorder. Things that are fragile do not like variability, volatility, stress, chaos, and random events, which cause them to either gain little or suffer. A teacup, for example, will not benefit from any form of shock. It wants peace and predictability, something that is not possible in the long run, which is why time is an enemy to the fragile. What’s more, things that are fragile respond to shock in a nonlinear fashion. With humans, for example, the harm from a ten-foot fall in no way equals ten times as much harm as from a one-foot fall. In political and economic terms, a $30 drop in the price of a barrel of oil is much more than twice as harmful to Saudi Arabia as a $15 drop.

For countries, fragility has five principal sources: a centralized governing system, an undiversified economy, excessive debt and leverage, a lack of political variability, and no history of surviving past shocks. Applying these criteria, the world map looks a lot different. Disorderly regimes come out as safer bets than commonly thought—and seemingly placid states turn out to be ticking time bombs.

THE CENTER CANNOT HOLD

The first marker of a fragile state is a concentrated decision-making system. On its face, centralization seems to make governments more efficient and thus more stable. But that stability is an illusion. Apart from in the military—the only sector that needs to be unified into a single structure—centralization contributes to fragility. Although centralization reduces deviations from the norm, making things appear to run more smoothly, it magnifies the consequences of those deviations that do occur. It concentrates turmoil in fewer but more severe episodes, which are disproportionately more harmful than cumulative small variations. In other words, centralization decreases local risks, such as provincial barons pocketing public funds, at the price of increasing systemic risks, such as disastrous national-level reforms. Accordingly, highly centralized states, such as the Soviet Union, are more fragile than decentralized ones, such as Switzerland, which is effectively composed of village-states.

States that centralize power often do so to suppress sectarian tension. That inability to handle diversity, whether political or ethnoreligious, further adds to their fragility. Although countries that allow their sectarian splits to remain out in the open may seem to experience political turmoil, they are considerably more stable than those that artificially repress those splits, which creates a discontented minority group that brews silently. Iraq, for example, had a Sunni-minority-led regime under Saddam Hussein that repressed the Shiites and the Kurds; the country overshot in the opposite direction after Prime Minister Nouri al-Maliki, a Shiite, took office in 2006 and began excluding the Sunnis. Indeed, research by the scholar Yaneer Bar-Yam has shown that states that have well-defined boundaries separating various ethnic groups experience less violence than those that attempt to integrate them. In other words, people are better next-door neighbors than roommates. Thus, in countries riven by sectarian divides, it makes more sense to give various groups their own fiefdoms than to force them to live under one roof, since the latter arrangement only serves to radicalize the repressed minority.

Moreover, centralization increases the odds of a military coup by making the levers of power easier to seize. Greece, for example, was highly centralized when a group of colonels overthrew the government in 1967. Italy might have appeared just as vulnerable around the same time, given that it also suffered from widespread social unrest and ideological conflict, but it was saved by its political decentralization and narrow geography. The various economic and political centers were both figuratively and literally far from one another, distance that prevented any single military faction from seizing power.

Just as states composed of semiautonomous units have fared well in the modern era, further back in history, the most resilient polities were city-states that operated under empires that provided a measure of protection, from Pax Romana to Pax Ottomana. But at the tail end of their existence, many empires began to centralize, including Pharaonic Egypt and the Ming dynasty in China. In both cases, the empires tightened the reins after, not before, they thrived, ruling out centralization as a cause of their success and fingering it as an explanation for their subsequent failure.

City-states both old and new—from Venice to Dubai to Geneva to Singapore—owe their success to their smallness. Those who compare political systems by looking at their character without taking into account their size are thus making an analytic error: city-states are remarkably diverse in terms of their political systems, from the most democratic (Venice) to the most enlightened but autocratic (Singapore). Just as an elephant is not a large mouse, China is not a bigger version of Singapore, even if the two share similar styles of government.

Again, consider Lebanon. For much of history, the Mediterranean was ringed by multilingual, religiously tolerant, and obsessively mercantile city-states, which accommodated a variety of empires. But most were eventually swallowed up by the modern nation-states. Alexandria was consumed by Egypt, Smyrna by Turkey, Thessaloniki by Greece, and Aleppo by Syria. Luckily for Lebanon, however, it was swallowed up by Beirut, not vice versa. After the collapse of the Ottoman Empire, the state of Lebanon was small and weak enough to get colonized by the city-state of Beirut. The result: over the past half century, living standards in Lebanon have risen in comparison to its peers. The country avoided the wave of statism that swept over the region with Gamal Abdel Nasser in Egypt and the Baath Party in Iraq and Syria, a trend that concentrated decision-making power and created dysfunctional bureaucracies, leading to many of the region’s problems today.

UNSTEADY-STATE ECONOMY

The second soft spot is the absence of economic diversity. Economic concentration can be even more harmful than political centralization. Economists since David Ricardo have touted the gains in efficiency to be had if countries specialize in the sectors in which they hold a comparative advantage. But specialization makes a state more vulnerable in the face of random events.

For a state to be safe, the loss of a single source of income should not dramatically damage its overall economic condition. Places that depend on tourism, for example, are particularly susceptible to perceived instability (as Greece discovered after its economic crisis and Egypt discovered after its revolution), as well as unrelated events (as Hawaii found out immediately after 9/11) and even just the vagaries of fashion, as new hot spots replace older ones (as Tangier, Morocco, has come to recognize). Another common source of fragility is an economy built around a single commodity, such as Botswana, with its reliance on diamonds, or a single industry that accounts for the lion’s share of exports, such as Japan’s automobile sector. Even worse is when large state-sponsored or state-friendly enterprises dominate the economy; these tend to not only reduce competitiveness but also compound the downside risks of drops in demand for a particular commodity or product by responding only slowly and awkwardly to market signals.

The third source of fragility is also economic in nature: being highly indebted and highly leveraged. Debt is perhaps the single most critical source of fragility. It makes an entity more sensitive to shortfalls in revenue, and all the more so as those shortfalls accelerate. As Lehman Brothers experienced when it collapsed in 2008, as the confidence of investors wanes and requests for repayment grow, losses mount at an increasing rate. Debt issued by a state itself is perhaps the most vicious type of debt, because it doesn’t turn into equity; instead, it becomes a permanent burden. Countries cannot easily go bankrupt—which, ironically, is the main reason people lend to them, believing that their investments are safe.

Leverage raises risks in much the same way. Dubai, for example, has plowed money into aggressive real estate projects, increasing its operating leverage and thus making any drops in revenue extremely threatening. Profit margins there are so thin that shortfalls could easily accelerate, which would rapidly push the emirate’s companies into the red and drain state coffers. This means that Dubai, in spite of its admirable structure and governance, can rapidly go insolvent—as the world witnessed after the 2008 financial crisis, when Abu Dhabi had to bail it out.

THE VIRTUE OF VOLATILITY

The fourth source of fragility is a lack of political variability. Contrary to conventional wisdom, genuinely stable countries experience moderate political changes, continually switching governments and reversing their political orientations. By responding to pressures in the body politic, these changes promote stability, provided their magnitude is not too large—more like the gap between the Labour Party and the Conservative Party in the contemporary United Kingdom than that between the Jacobins and the royalists in revolutionary France. Moderate political variability also removes particular leaders from power, thus reducing cronyism in politics. When a state is decentralized, the variations are smoother still, since municipalities distribute decision-making power and allow for a plurality of political views.

It is political variability that makes democracies less fragile than autocracies. Italy is resilient precisely because it has been able to accommodate virtually constant political turmoil, training citizens for change and incubating institutions able to correct for mild instability. So far, perhaps predictably, none of the former dictatorships touched by the Arab Spring has demonstrated any such capacity. Egypt has reverted to military rule, and the others have fallen into varying degrees of chaos. Some states that emerged from autocratic rule without devolving into turmoil were able to develop means of accommodating change. Spain under Francisco Franco, for instance, over time became more and more an autocratic façade behind which the institutions of civil society could develop.

The fifth marker of fragility takes the proposition that there is no stability without volatility a step further: it is the lack of a record of surviving big shocks. States that have experienced a worst-case scenario in the recent past (say, around the previous two decades) and recovered from it are likely to be more stable than those that haven’t. In part, this marker is simply providing information: countries that sustain chaos without falling apart reveal something about their strength that could not be discovered otherwise. But this marker also involves the idea of “antifragility,” the property of gaining from disorder. Shocks to a state are educational, causing them to experience posttraumatic growth.

Look at Indonesia, Malaysia, the Philippines, South Korea, and Thailand. The fact that these countries weathered the 1997–98 Asian financial crisis suggests that they were robust enough to survive—and their impressive subsequent performance suggests that they might even have been antifragile, adjusting their institutions and practices based on the lessons of the crisis. Likewise, the fact that the former Soviet states have recovered from the collapse of the Soviet Union suggests that they are also relatively stable. The idea is analogous to child rearing: parents want to protect their children from truly serious shocks that they might not survive but should not want to shelter them from the challenges in life that make them tougher.

THE BEAUTIFUL AND DAMNED

These five markers function best as warning signals. They cannot indicate with high confidence whether a given country is stable—no methodology can—but they certainly can reveal if a given country should cause worry. Those countries that score poorly on multiple criteria are particularly concerning, since these markers are compounding: qualifying as fragile on two counts is more than twice as dangerous as doing so on one. When it comes to overall fragility, countries can vary from exhibiting no signs of fragility to being very fragile.

Saudi Arabia is an easy call: it is extremely dependent on oil, has no political variability, and is highly centralized. Its oil wealth and powerful government have papered over the splits between its ethnoreligious units, with the Shiite minority living where the oil is. For the same reason, Bahrain should be considered extremely fragile, mainly on account of its repressed Shiite majority.

Egypt should also be considered fragile, given its only slight and cosmetic recovery from the chaos of the revolution and its highly centralized (and bureaucratic) government. So should Venezuela, which has a highly centralized political system, little political variability, an oil-based economy, and no record of surviving a massive shock. Some of the same problems apply to Russia. It remains highly dependent on oil and gas production and has a highly centralized political system. Its one redeeming factor is that it surmounted the difficult transition from the Soviet era. For that reason, it probably lies somewhere between moderately fragile and fragile.

Some countries are best categorized as fragile but possibly doing something about it. Greece holds enormous quantities of debt and has an inflexible political system, but it has begun to undertake an economic restructuring. (Time will tell whether this is the beginning of a new era of responsibility or a false start.) Iran has an effectively centralized government that exhibits little variability and an economy tied to oil and gas production, yet the regime has been tolerating (although only implicitly) a measure of political dissent. And although Iran is nominally a theocracy, unlike Saudi Arabia, it appears to have an extremely adaptive form of Islam that may accommodate modernization. Greece and Iran could transform into more robust states or lapse into fragility.

Moderately fragile states include Japan, given its highest-in-the-world debt-to-gdp ratio, long-term dominance by a single party, dependence on exports, and failure to fully recover from its “lost decade”; Brazil, which is growing increasingly centralized and bureaucratized; Nigeria, which is highly centralized and dependent on oil yet has rebounded from the economic and political turmoil of the 1980s and proved somewhat adaptable in the face of new threats, such as the Islamist insurgent group Boko Haram; and Turkey, which is highly centralized and has no track record of recovery. (In addition, Turkey’s dependence on foreign investment is incompatible with its aggressive pro-Islamist foreign policy, which turns off Western investors.) India is perhaps best considered slightly fragile. Its political system is relatively decentralized and has adapted to rapid population growth and uneven economic progress, and its economy is somewhat reliant on exports.

Italy, paradoxically, shows no signs of fragility. It is effectively decentralized and has bounced back from perennial political crises. It also experiences a great deal of harmless political variability, cycling through 14 prime ministerial terms in the past 25 years. France, by contrast, is more fragile—centralized (in spite of the lip service it pays to decentralization), indebted, and without a demonstrated comeback. The country is at risk of economic trauma, which would raise the danger of erratic political reactions. Those, in turn, would likely enhance the appeal of right-wing factions and radicalize the country’s significant Muslim minority.

Then there is the China puzzle. China’s stunning economic growth makes its future hard to assess. The country has recuperated remarkably well from the major shocks of the Maoist period. That era, however, ended nearly four decades ago, and so the recovery is hardly a recent comeback and thus less certain to protect against future shocks. What’s more, China’s political system is highly centralized, its economy is dependent on exports to the West, and its government has been on a borrowing binge as of late, making the country more vulnerable to slowdowns in both domestic and foreign growth. Are the gains from past turmoil big enough to offset the weakness from debt and centralization? The most likely answer is no—that what gains China has accrued by learning from trauma are dwarfed by its burdens. With each passing year, those lessons recede further into the past, and the prospects of a Black Swan of Beijing loom larger. But the sooner that event happens, the better China will emerge in the long run.

Foreign Affairs

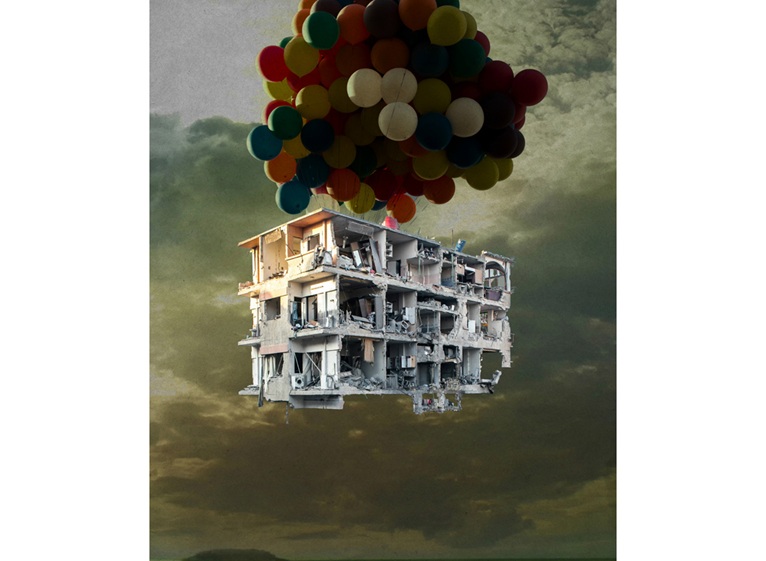

Top Photo : Syrian artist Tammam Azzam highlights the fragility of Syrian political structures in the wake of revolution in his Bon Voyage paintings . Within his digital collages, brightly colored bunches of balloons carry war-torn buildings lifted straight from the streets of Damascus high above some of the world’s best-known political headquarters and landmarks.

Leave a Reply

You must be logged in to post a comment.