THE first year after the fall of Hosni Mubarak in February 2011 was messy but hopeful. After 30 years of dictatorship, elections brought to power the Muslim Brotherhood, who—although they had suffered decades of persecution—promised to be inclusive and tolerant. But since the Brothers’ Muhammad Morsi became president at the end of June last year, politics has become steadily nastier. Egyptian society is ever more polarised. Protests frequently turn violent. The security forces oscillate between support for the Islamists and deep-seated suspicion of them. All the while Egypt’s economy is sliding towards disaster (see article). Unless Mr Morsi takes drastic steps soon, it could crash. If that happens, Egypt could succumb to lasting turmoil.

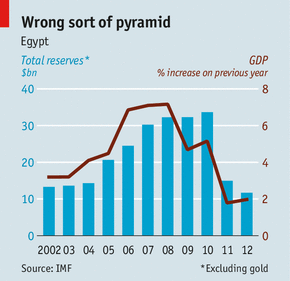

Virtually every economic indicator points to trouble. The currency has slid by 10% since January. Unemployment may be as high as 20%. The stock exchange this year has slumped by a tenth. Tourism, which used to account for 12% of Egypt’s GDP, has evaporated. Foreign investment has dried up. Foreign reserves have shrunk. Many of Egypt’s most dynamic businessmen have fled, fearing they will be arraigned for complicity with Mr Mubarak. The government is threatening to reverse a number of privatisations. Meanwhile, the price of food is soaring at a time when the average family already spends almost half its income to feed itself. A good quarter of Egypt’s 83m people live below the poverty line.

The IMF has promised to lend $4.8 billion and an array of foreign banks and investors say they will pile in after a deal with the fund is clinched. But first the government will have to embark on tough but essential reforms—tackling the country’s wasteful system of food and fuel subsidies, which gobble up some $20 billion year. Diesel alone, which powers the pumps irrigating Egypt’s farms, accounts for $7.5 billion in subsidies and is sold to consumers at the equivalent of 16 cents a litre, whereas most Europeans pay $2 or more. Queues for fuel in some towns stretch for more than a mile.

Short of money, short of time

Terrified that its already falling popularity will plunge further, the government has done almost nothing to stop the drift. It has promised to reduce and target subsidies while protecting the poorest, but so far has trimmed only around the edges, for instance by raising fuel prices for some industries. It says it may make drivers of cars with big engines pay closer to the real price. It is also said to be poised to double import duties on a range of luxury goods. And it has implored rich Arab countries, notably Saudi Arabia and Qatar but now, more surprisingly, Libya and Iraq, to offer financial support out of compassion for fellow Muslims.

Sharper cuts in subsidies are needed, but they would be wildly unpopular, and the government has neither the will nor the authority to implement them. An election scheduled for April has been postponed, probably until August at the earliest. If Egypt is lucky, the vote will produce a government with a stronger mandate, but the country must not continue to drift until then.

Egypt needs a government that can take some difficult decisions swiftly. To that end, Mr Morsi should select a fresh team of ministers from a much wider ideological spectrum, including technocrats and secular-minded people as well as his own Islamist brethren. Together they might share the opprobrium that will inevitably result from the measures needed to do a deal with the IMF and get the economy working. Without people willing to put their country before themselves, Egypt faces economic collapse.

The Economist

Leave a Reply

You must be logged in to post a comment.