Data: U.S. Census; Chart: Axios Visuals

China’s exports dipped last year for the first time since 2016, according to official data, in another worrying economic trend for the manufacturing-driven economy amid slowing global growth.

The $3.38 trillion worth of products that China sold to the world last year was 4.6 percent less than in 2022. It came off the back of falling demand and rising interest rates in foreign markets, according to Bloomberg, which cited China’s customs authorities.

China is grappling with a number of economic woes including a slowing economy, a reeling property market and restricted access to emerging technology such as semiconductors and lithography machines.

High youth unemployment and low domestic consumption have also added to Beijing’s troubles at a time when the country’s leaders were hoping to jump-start economic activity after the COVID-19 pandemic.

The U.S. Commerce department and China’s State Council—its cabinet—didn’t immediately respond to Newsweek‘s separate requests for comment.

For the third consecutive year, economic growth worldwide is expected to slow this year, averaging just half the pace seen before the pandemic, the World Bank reported last week.

China‘s annual total imports last year were down 5.5 percent from $2.5 trillion in 2022, according to the customs report.

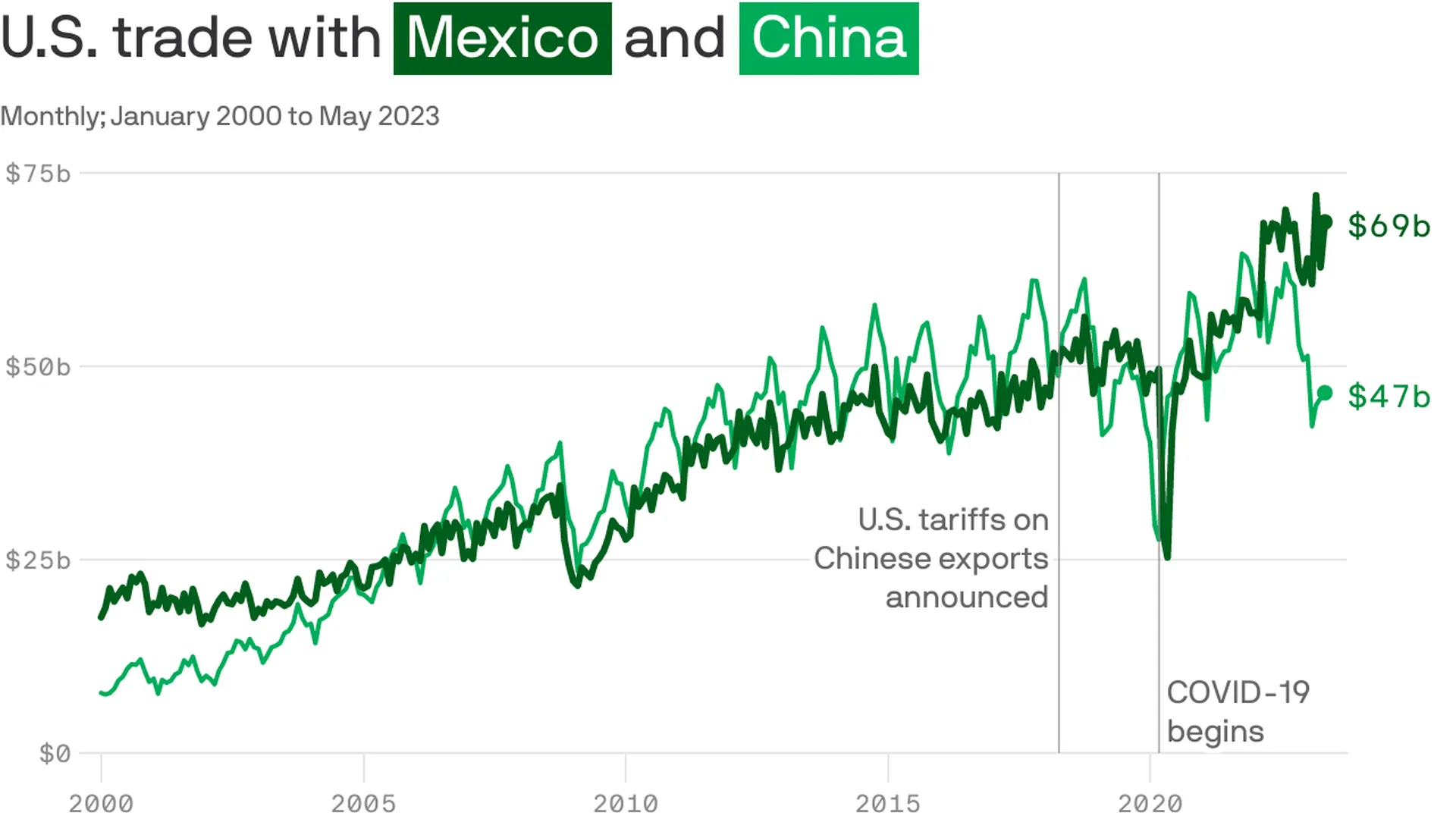

Last year, Mexico replaced China as the U.S.’s top trading partner after the latter had topped the list most of the past decade. However, the United States remains China’s top destination for exports, with shipments to the world’s largest economy comprising 16.2 percent of Chinese total exports in 2022.

It was not all bad news for China on the trade front. Year-end exports were up 2.3 percent in December, over three times higher than November’s 0.5 percent and 0.6 percentage points higher than economists’ median prediction in a recent Reuters poll.

Emily Jin, a research associate at the Center for a New American Security think tank, told Newsweek China’s real estate market slump and falling consumer spending—already major headwinds for the Chinese economic engine—were further exacerbated by the pandemic and the stringent measures the Chinese government rolled out in response.

President Xi Jinping of China increasingly favors a “top-down approach to control finance and shift of resources from real estate to strategic sectors.”

The statist approach is widely seen as getting in the way of growth, she pointed out.

Earlier this month, Chinese Forei

gn Ministry spokesperson Wang Wenbin conveyed Beijing’s public optimism about the country’s economic prospects. He cited a projection by the International Monetary Fund that said China would account for a third global growth in 2024.

In his New Year’s Eve address, Xi gave a rare acknowledgement of some of the nation’s financial difficulties, saying Chinese businesses “had a tough time.” “Some people had difficulty finding jobs,” he said.

China’s estimated 4.6 percent GDP growth last year, based on Beijing’s official data, was 54 percent higher than America’s, per the World Bank. However, it still fell short of Beijing’s stated goal of around 5 percent annual growth, which analysts believe is necessary if it wants to overtake the U.S. as the world’s No. 1 economic power.

Instead, the gap between the two largest economies widened last year. China’s economy was only two-thirds the size of the U.S.’s, down from 70 percent in 2022 and 76 percent in 2021.

Leave a Reply

You must be logged in to post a comment.