The automotive industry’s adoption of lithium-ion batteries has turned lithium, a chemical element until now extracted in small amounts, into a strategic resource whose production will only increase.

The dreamed-of transition to a fully electric future within the next 10 years has sparked a worldwide race to mine and refine this new white gold to fuel the transport of tomorrow.

Home to more than 65 percent of the world’s known reserves, could Latin America’s “Lithium Triangle” formed by Argentina, Bolivia and Chile become

the Saudi Arabia of the 21st century?

What is lithium?

Lithium (Li) is a chemical element that at its purest takes the form of a soft silver metal. Present in more than 145 types of mineral ores, it is never found in its native metal form. Instead, it can be extracted from hard rock, as in Australia, or recovered by solar evaporation in large saltwater brine basins, as in the South American Andes – the simplest and cheapest method. In 2020, the EU declared lithium a “critical raw material” along with cobalt and nickel, which are also used to make the batteries needed for the energy transition.

Lithium carbonate at an SQM factory in Chile. Rodrigo Abd, AP

What is a lithium-ion battery?

Lithium-ion batteries are based on a flow of lithium ions between a positive electrode containing cobalt or manganese and a negative graphite electrode. Developed in the 1970s, lithium batteries have since become the most efficient means of storing electricity. The technology has been widely adopted by the automotive industry over the past decade, and the need for lithium will likely multiply by a factor of 18 by 2030, and a factor of 60 by 2050.

Creative Department France Médias Monde

How much lithium is there in an electric car?

Electric car batteries can weigh up to 400 kilograms and contain at least 10 kg of pure lithium. A Tesla contains 80kg of lithium, an electric bike 300 grams and a bus as much as 200kg.

Creative Department France Médias Monde

How many electric cars are there in Europe?

One in five cars sold in the European Union in August 2023 were 100 percent electric, according to the European Automobile Manufacturers’ Association (ACEA). Factoring in hybrid models, sales of electric cars have reached almost 50 percent of new vehicles sold since the start of 2023. But according to Eurostat, at the end of 2022, they still accounted for just 0.8 percent of the total number of vehicles currently in circulation in Europe. The ban on combustion engines in the EU is set to take effect in 2035.

When will the ban on the sale of combustion engines take effect?

Europe:

2025: Norway

2035: EU, UK

US:

2030: Half of all cars sold in the US have to be “zero-emissions” vehicles.

2035: Ban on the sale of combustion engines in California and New York State (with the exception of plug-in hybrids).

Asia:

By 2025: China is aiming for 20 percent of vehicles to be powered by “new energies” (electric, hybrid or fuel cell), which are set to become the “mainstream” by 2035, according to a document published by Beijing at the end of 2020.

2030: India has set itself the objective of 30 percent electric vehicle sales.

2035: Japan plans to ban the sale of combustion engine-powered vehicles, with the exception of hybrid cars.

How much does lithium cost?

The price for a tonne of lithium was about $6000 in 2020 and reached a peak of $88,000 at the end of 2022. It is currently trading at around $27,500. The value of lithium represents just 1 to 2 percent of the final price of an electric vehicle battery.

From lithium to electric batteries: A new geopolitics of energy?

European governments and manufacturers have been slow to realize the consequences of banning the sale of combustion engines on the continent as of 2035. Carmakers need to secure access as soon as possible to the raw materials needed to make lithium-ion batteries and take ownership of the other stages of their production. Dependent on imports and a production chain largely dominated by China, the Europeans are racing against the clock to carve out a place for themselves in the new world of lithium-powered electric transport.

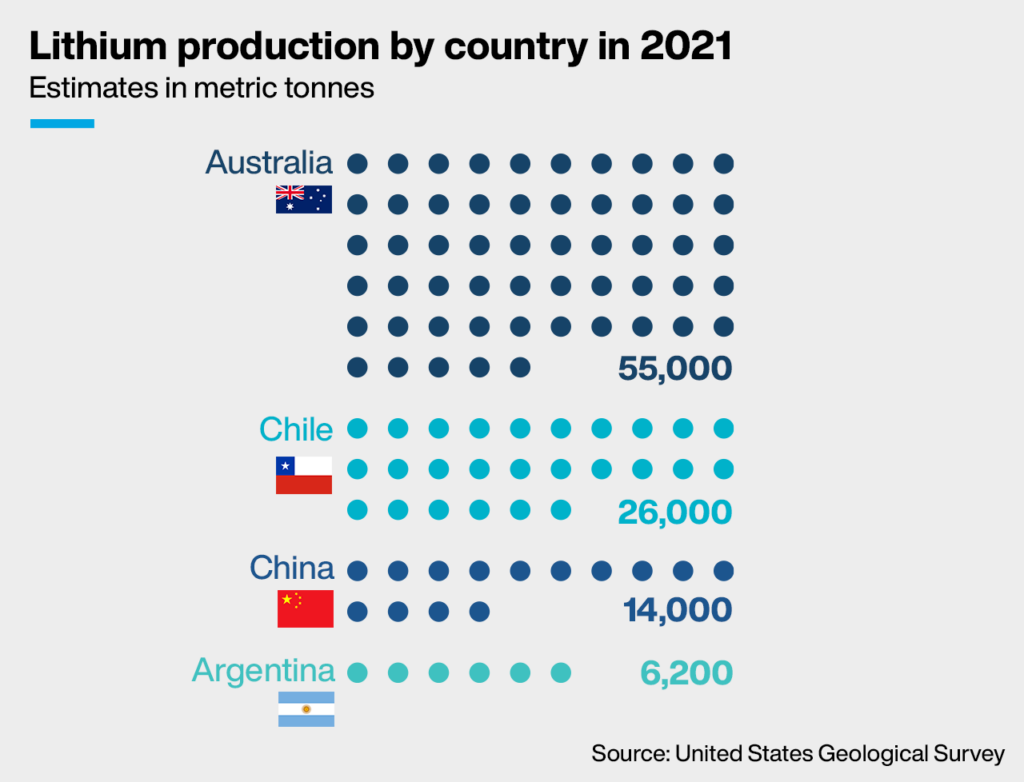

Which countries produce lithium?

The European automotive industry imports 100 percent of its lithium needs. The main producers are currently Australia, Chile, China and Argentina.

Where are the main known lithium deposits?

At least 60 percent of the world’s available lithium resources are found in South America’s ABC triangle (Argentina, Bolivia, Chile), according to the US Geological Survey. More precisely, they are found in the salt flats of the Andean highlands – such as the Uyuni salt flats in Bolivia or the Atacama Desert in Chile.

What are the main steps for processing lithium for electric batteries?

Evaporation basins in a saltworks in Argentina’s Jujuy province in October 2022. Martin Silva, AFP

Mining and refining

In saltworks, lithium extraction involves boring a well to pump salt-rich water into large, shallow basins, where it is evaporated by the sun. It takes between 18 and 24 months to produce a brine rich in lithium chloride. Around 2 million liters of water evaporate for every tonne of lithium produced.

Several chemical processes are then used to obtain lithium carbonate or lithium hydroxide, which is bought by electric battery manufacturers. Five major corporations dominate this market: Albemarle (US), Ganfeng Lithium (China), SQM (Chile), Tianqi (China) and Livent (US).

Battery manufacturing and assembly

After making anodes, cathodes and separators, manufacturers produce lithium-ion cells that are integrated into a shock-resistant battery equipped with a heating and cooling system and electronic control unit.

This is where the famous giga factories come in, massive assembly plants whose vast output is measured in gigawatt hours. The term was introduced by US automotive multinational Tesla in 2013 to describe the first giga factory producing batteries for its electric cars. In years to come, these giga factories could also recycle used batteries and integrate the assembly lines of the electric cars themselves.

Right now, Chinese businesses account for around 70 percent of the electric vehicle battery market, followed by Korean and Japanese manufacturers. Fully one-third of the world’s electric vehicle batteries come from the Chinese corporation CATL alone.

Who can challenge China’s supremacy?

China is today leading every step in the electric vehicle production chain. Although its corporations only account for 14 percent of the actual lithium mining, they are responsible for 89 percent of its refining. With 75 percent of the world’s lithium-ion cell manufacturing and 70 percent of its battery production plants, China is also the leading producer of electric vehicles, responsible for 43 percent of global production.

Can Europe catch up?

Faced with the challenge of transitioning to widespread electric car use over the next decade, the EU has invested massive public support in catching up with China in battery production. This policy has been both risky and ineffective, according to a report by the European Court of Auditors released in mid-June 2023.

> Read more

The EU is also trying to secure its access to lithium, as demonstrated by the signing of a memorandum of understanding with Argentina on June 14 on essential raw materials, including lithium.

> Read more

Some 40 giga factories are either planned or already up and running in the EU, including four in France, to keep up with competition from China and the US. The stakes are high: independence and sovereignty.

South America dreams of El Dorado

Since the Spanish conquistadors first set foot in South America in the 16th century, extractivism has brought little happiness to Latin Americans. Instead, the continent’s mineral wealth has often been synonymous with vast fortunes for the privileged few and abject poverty for the many.

With its immense lithium deposits – 65 percent of the known global reserves are found in a triangle formed by Argentina, Bolivia and Chile – South America is determined not to let the revenues from this indispensable metal slip away. Across the continent, governments dream of mastering the exploitation of this new white gold that will power the vehicles of tomorrow.

Martin Obaya, a lithium specialist and an economist at Conicet, Argentina’s National Scientific and Technical Research Council, spoke with FRANCE 24 about the lofty ambitions and stubborn realities of the three countries that make up the “Lithium Triangle”.

FRANCE 24: With its lithium reserves, could Latin America become the Saudi Arabia of the 21st century?

Martin Obaya: The short answer to that question would be no. It’s true that the majority of the world’s lithium resources are found in Argentina, Bolivia and Chile. But we mustn’t lose sight of the fact that the extractive industries are very dynamic and that as prices and needs increase, new deposits will very likely be found in other parts of the world.

New deposits are being discovered – in the US as well as in Europe – that are often non-traditional, like for example Germany’s geothermal deposits. This is because lithium is a very geologically abundant resource on Earth.

Lithium is a very geologically abundant resource on Earth

Certain kinds of deposits are not economically viable with the technology that we have at our disposal today. But as new technologies are developed and the price of lithium remains relatively high, new sources of lithium supplies are likely to emerge.

We should also note that of these three countries, Bolivia alone accounts for around 22 percent of the world’s lithium resources. But Bolivia has run into difficulties because its saltworks are very rich in magnesium.

FRANCE 24: How is the lithium industry developing in Argentina, Chile and Bolivia?

Martin Obaya: The three countries have adopted very different development models. The triangle metaphor hides importance differences.

Three lithium-mining models in South America

Argentina: Huge potential for expansion through the private sector, with little state involvement.

Bolivia: Highly state-controlled mining operations, making the development of industrial-scale businesses very difficult.

Chile : Guidelines set by the state. The country with the most experience, and the most production.

In Argentina, lithium is mined within the general regulatory framework for mining operations, which is very liberal and which was adopted in the 1990s. That means that lithium projects can be freely leased to the private sector. Furthermore, Argentina is the only country in the region with a federal system, which means that lithium mining is administered by the provinces. Each province grants concessions and sets environmental controls. There are currently more than 30 projects in development across the country.

In 2008, Bolivia adopted a strategy of strong state control, which gives the state the monopoly on saltworks operations with the state-owned company YLB (Yacimientos del litio boliviano), which was created in 2017. In 2010, its strategy was to create pilot plants, an industrial plant capable of producing 15,000 tonnes of lithium carbonate and a battery production plant. So far, it has only been able to build the pilot plants. This year, Bolivia launched a new partnership strategy with Chinese and Russian consortia to develop a direct extraction method – something that is still experimental.

Chile has had a very dynamic system somewhere between the two since the 1990s. In Chile, the state owns the deposits. They can’t be leased to private companies. But the state has signed contracts that have allowed private extraction in exchange for royalties. In 2023, the government announced a new national lithium strategy as well as the creation of a public company. It’s very likely that the state will try to renegotiate with SQM (Editor’s note: Sociedad Química y Minera, a private Chilean lithium mining company and a major player in the sector) by becoming a partner. This strategy also leaves open the possibility for the Chilean state to exploit other saltworks through this new company.

FRANCE 24: What do Chile and Argentina export? The raw material or a product that has already been processed?

Martin Obaya: People often talk about the need for our countries to stop exporting raw materials. In the case of lithium, though, there is a distinction to be made between the extraction of lithium from rocks and that which is made through evaporation in saltworks.

Australia, the world’s leading lithium producer, practices rock-based extraction. They export a rock that has undergone very little chemical treatment, resulting in a product that contains six percent lithium. Almost 100 percent of this is exported to China. In Argentina and Chile, lithium is exported directly in the form of lithium carbonate and, in the case of Chile, there is even small-scale production of lithium hydroxide.

Australia exports raw materials. Argentina and Chile export a refined product, lithium carbonate

Lithium carbonate has a much higher price. Its degree of sophistication is also increasing as the technical specifications set by the automotive companies and the battery cell manufacturers become more and more precise. The product therefore has a much higher export price than that which is exported by Australia.

FRANCE 24: Having traditionally been exporters of raw materials, Latin American countries want to use lithium to become exporters of high value-added products. Is this ambition achievable?

I think that what’s becoming very clear now is that it’s hard to produce batteries in Latin America. The global market for batteries is growing, and this production goes hand in hand with the development of an electromobility industry. It’s complicated enough to produce batteries. Even Europe has struggled to develop production plants.

Our politicians think that since we’re producing lithium, we can make batteries. This idea is a little simplistic, as the development of batteries needs to be very close to the major (automotive) markets and we have to remember that lithium represents less than 10 percent of the production cost of a battery.

FRANCE 24: With their lithium reserves, can Latin American countries build a new relationship with China?

China occupies a dominant position in every part of the chain. Many lithium deposits are controlled by Chinese companies. But China’s presence extends equally to other types of natural resources.

From a political point of view, the negotiating capacity of the Argentine government, which is also financially dependent on the Chinese government, is reduced. Argentina has tried to stay equidistant from the US and China in terms of natural resources, but China is the main buyer of its raw materials and agricultural products.

The Bolivian government has chosen China as a partner to develop new direct-extraction technologies, because it believes that China is more in line with its geopolitical interests.

China’s domination of access to natural resources is pretty worrying

I think that China’s domination of access to natural resources is pretty worrying. And above all, to be honest, it seems to me that Europe is not in a favourable position.

Europe has been weakened by the difficulties that it has faced in establishing stable and secure supply lines for raw materials over time. One of the main concerns of European automotive manufacturers is how to secure the raw materials to be able to make batteries and not to buy them from China. But they’re far behind schedule.

European carmakers are far behind schedule in securing their access to raw materials

FRANCE24

Leave a Reply

You must be logged in to post a comment.