By Ali Bakir

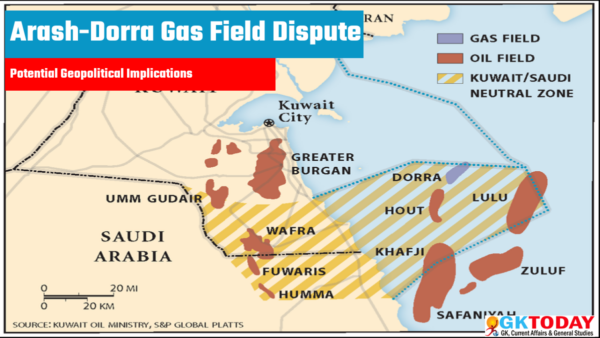

In a surprising move in July 2022, Iran reignited an age-old conflict with its Gulf neighbors, Kuwait and Saudi Arabia. The controversy? Exploration and drilling rights in the offshore Dorra gas field, which is named after the Arabic term for a “precious large pearl” and also known as “Arash” in Persian. The Dorra field, lying in the submerged Neutral Zone, between Kuwait and Saudi Arabia, promises significant economic returns. With reserves estimated at 300 million barrels of oil and around 11 trillion cubic feet of gas, it is no wonder the region is a hotspot of contention.

The Dorra dispute is not new—its roots stretch back to the tumultuous 1960s when Iran and Kuwait granted conflicting exploration rights to distinct companies. This situation halted gas exploration in the area, embedding a deep-seated dispute over ownership and development rights that persists to this day.

Iran’s recent assertiveness on this issue was best captured by Mohsen Mehr, the executive director of Iran’s National Oil Company. Last June, Mehr confidently declared the company’s readiness to launch drilling operations in the Dorra field, promising an imminent start given favorable geopolitical conditions. This bold statement came hot on the heels of a fruitless negotiation round with Kuwait in March. Kuwait demanded the establishment of a clear-cut mechanism to demarcate maritime boundaries—an endeavor that remains elusive amid Iranian refusal.

Iran proposed special quota formulas for the gas field and enticing joint investments to avoid entering a negotiation process on the delimitation of maritime borders. However, Tehran’s push for a quota-sharing principle fell on deaf Saudi ears.

Iran’s territorial claims have been audacious, to say the least. While the country’s maritime borders with Kuwait remain in limbo, Tehran hasn’t hesitated to claim its stake. Some Iranian legislators tout a 40 percent share of the field, while state media outlets speculate figures as high as 70 percent. On the other hand, Saudi Arabia and Kuwait, with their demarcated borders, maintain they hold exclusive rights over the Dorra field. This divergence has been a significant obstacle to a resolution.

Unlike Iran and Saudi Arabia—both rich in gas reserves—the Dorra gas field is a lifeline for Kuwait. It stands as Kuwait’s sole significant conventional non-associated gas field. The nation’s gas is primarily a byproduct of its oil output, supplemented by long-term LNG contracts from Qatar.

In a pivotal move in March 2022, Kuwait and Saudi Arabia inked a deal to harness the Dorra field’s potential. Aiming for a capacity of one billion cubic feet and 84,000 barrels of condensate daily, the countries embarked on exploration via Al-Khafji Joint Operations (KJO). This venture is a collaboration between the Kuwait Gulf Oil Company and Saudi Aramco Gulf Operations, focusing on the Neutral Zone.

The neutral zone sees Kuwait and Saudi Arabia splitting the revenue from oil extraction down the middle. The stakes are high, with a staggering 30 billion barrels of oil and 60 trillion cubic feet of gas in reserves. Iran, however, vociferously opposed this agreement, dismissing it as unlawful and championing quota allocations instead.

The chessboard: strategies in play

Iran’s maneuvers in this dispute are multifaceted. At the heart of its strategy lies a principle as old as conflict itself: divide and conquer. Tehran is keen on separating Kuwait from its traditional Gulf allies—chiefly, Saudi Arabia. By advocating for unilateral negotiations centered on the Dorra field, Iran aims to leverage its asymmetric relationship with Kuwait. The objective is clear: pressure Kuwait into making concessions. The subtext is that unilateral negotiations with Kuwait would stir Saudi Arabian suspicions about a possible deal that might cut them out, driving a wedge between Kuwait and Riyadh and furthering Iran’s interests.

Yet, Tehran’s strategies aren’t solely about division. They also blend incentives and threats—a classic ‘carrots and sticks’ approach. The Iranian leadership offers a quotas formula for the Dorra field or potential joint developmental projects. However, these overtures are balanced with subtle threats of unilateral actions. The intent is to back Kuwait into a corner, making it choose between cooperation or confrontation. This brinkmanship risks setting the stage for an escalation that could be both dangerous and irreversible.

Anticipating Iran’s gambit, Kuwait has rolled out its countermeasures. In response to Tehran’s assertive posturing, Kuwait’s strategy affirms unity in ranks with Saudi Arabia, underlining the Gulf duo’s singular stance on the Dorra field. This unity extends to the negotiation table, as Kuwait’s strategy asserts a joint front with Saudi Arabia. By roping in Saudi Arabia for negotiations against Iran, Kuwait aims to thwart Tehran’s designs and tip the scales in favor of the Gulf monarchies in any potential negotiations.

The third pillar in Kuwait’s strategy is to uphold the legal grounds for their case. In the absence of delimitated maritime borders, Kuwait holds on to the position that Tehran’s maritime claims have no basis and that the Dorra field is exclusively a Kuwaiti-Saudi field. This stance deprives Iran of maneuvering space and directs the dispute back to border delimitations rather than the Dorra field. “Whoever has a claim must start demarcating the borders. And, if it has a right, it will take it according to the rules of international law,” Kuwait’s Deputy Prime Minister and Minister of Oil, Saad al Barrak, affirmed.

A verbal volley

Iranian officials contend that Kuwait once acknowledged Tehran’s stake in the Dorra field. However, they believe Kuwait’s recent pact with Saudi Arabia has bolstered its stance, leading it to renounce Tehran’s rights. Nasser Kanaani, the Iranian foreign ministry spokesperson, sternly warned that Tehran would prioritize its rights and interests absent a joint venture spirit. Kanaani’s stance echoed that of Iranian Oil Minister Javad Oji, who threatenedthat Iran won’t tolerate any infringement on its rights in the Dorra field.

Intriguingly, some Iranian officials advocate a more audacious approach: exploit the field’s resources first rather than stake a claim. They fear losing the initiative if Kuwait and Saudi Arabia beat them to it. Hedayatullah Khademi, Chairman of the Association of Iranian Oil and Gas Drilling Companies, sounded the alarm. He accused the Iranian government of sitting idle and emphasized that future endeavors could be stymied if Tehran does not kick-start extraction from the Dorra field this year.

On August 3, Kuwait and Saudi Arabia issued a joint communiqué, asserting their unassailable sovereign rights over the Dorra field’s riches. This volley of statements and counterstatements suggests that tensions could either simmer behind closed doors or erupt openly. Intriguingly, Iran’s renewed vigor in this dispute is a direct challenge to the budding normalization process with Saudi Arabia—an initiative shepherded by China.

The bigger picture

Beyond these contentious maritime and economic facets, there is an often-underplayed aspect: security. The Dorra field is nestled within the Gulf’s bustling energy hub, which is the lifeblood of global trade and energy. An unchecked escalation could unleash repercussions for the primary actors and ripple through the regional and international theater.

Recognizing the gravity of the situation, the US has decided to bolster its presence in the Gulf. Thousands of marines, backed by state-of-the-art fighter jets and naval vessels, have been dispatched. The USS Bataan’s deployment to the Gulf is particularly noteworthy, as it comes at a juncture when the Islamic Revolutionary Guard Corps (IRGC) is flexing its muscles. Iran aims to assert dominance over the Strait of Hormuz and apply pressure by intercepting international ships. Recent data reveals that Tehran has either seized or tried to take control of nearly twenty international ships in the past two years.

To further complicate matters, Russia, a known strategic partner of Iran, seems to be leaning toward the Gulf Arab countries. This shift becomes apparent in the sovereignty dispute over the three Gulf islands of Abu Musa and the Greater and Lesser Tunbs—territories the United Arab Emirates (UAE) claims as its own and is occupied by Iran. Former senior diplomat and the head of the Middle East division of the Iranian foreign ministry, Qasem Mohebbali, noted, “Apparently, Iran’s friends do not pay much attention to its demands and pay more attention to the rivals’ [Arab] demands.”

Adding to the complexity, the IRGC unveiled a sudden military drill on these contested islands at the beginning of August. IRGC head, General Hossein Salami, issued a stern warning during the exercise, emphasizing the nation’s readiness to counter what he called “all threats, complicated seditions, and secret scenarios and hostilities.”

Iran’s escalation of tension over the Dorra field is the first serious challenge to the China-sponsored normalization with Saudi Arabia. Accordingly, a looming question persists: how far can Iran stretch the normalization boundaries before they snap? Observing the reaction of Kuwait and Saudi Arabia, as well as the US stance, will offer insights into Iran’s next moves.

In a world grappling with the energy implications of the Russian-Ukrainian conflict, the Dorra field becomes a symbol of the broader power dynamics in the Gulf. While the immediate future remains uncertain, one thing is clear: the Dorra field is not just about gas. It is a litmus test for a regional de-escalation moment, alliances and alignments, diplomacy, and the ever-shifting sands of Gulf geopolitics. As Iran, Kuwait, and Saudi Arabia chart their paths, the outcome of the Dorra dispute could set the tone for the next stage of Gulf relations.

ATLANTIC COUNCIL

Leave a Reply

You must be logged in to post a comment.