A good loophole is hard to find

Stephen J. Choi, Mitu Gulati & Ugo Panizza

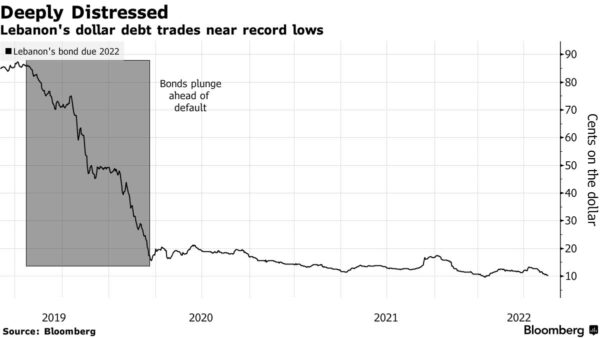

Lebanon’s debt crisis is a slow-moving train wreck. For three years it has been unable to implement reforms necessary for an IMF program — including a requirement to make progress in debt negotiations with private creditors. And when it does move ahead with creditor talks, it faces a heightened risk of holdouts.

Lebanon’s holdout risk derives from its confusing choice to not use Aggregated Collective Action Clauses, or CACs. These clauses, created to ameliorate the problem of holdout creditors, were widely adopted by sovereign debtors starting roughly a decade ago. The innovation allows a debtor to conduct a single aggregated vote across all of its bonds that will be binding, even for dissenters. Holdouts would be deterred, it was thought, because the size of the position needed to hold out would be large. But rather than adopting Aggregated CACs, Lebanon stuck with its old non-aggregated clauses.

The end result: Lebanon’s international bonds require the approval of 75 percent of the holders, in principal amount, for each bond series before key terms can be modified. Those single-series CACs, combined with the fact that Lebanon’s foreign currency bonds are trading at less than ten cents on the dollar, are blood in the water for specialist distressed-debt sharks .

But maybe not. Buried in the typical sovereign bond contract is a “manifest error” clause. This section doesn’t get much attention because it covers technical corrections; matters so minor that the debtor and the agents can fix them without approval from the creditors.

To protect against its misuse, the manifest error clause normally comes with two conditions: 1) The changes may not adversely affect the interests of any creditor. 2) The fiscal agent/trustee has to approve the change. Having a trustee who is an agent for the bondholders, as opposed to a fiscal agent, is better for the creditors, but that’s not relevant here as we will see.

For example, the manifest error clause in Mexico’s 2017 bond issue reads, in relevant part:

Mexico and the trustee may, without the vote or consent of any holder of debt securities of a series, amend the indenture or the debt securities of the series for the purpose of: – adding to Mexico’s covenants for the benefit of the holders;

– amending the debt securities of that series or the indenture in any manner that Mexico and the trustee may determine and that does not materially adversely affect the interests of any holders of the debt securities of that series;

or correcting, in the opinion of the trustee, a manifest error of a formal, minor or technical nature.

Lebanon’s manifest error clause, drawn from its 2010 Fiscal Agency Agreement, is different. The equivalent bits to Mexico’s clause read (with our emphasis):

“Without the consent of any Holder of Notes, the Republic . . . may enter into one or more Supplements for any of the following purposes

This is interesting for two reasons. First, Lebanon’s clause says that the Republic, on its own (ie without the agreement of the trustee) may add new provisions to the contract. Second, the provision has to be for the benefit of the “holders” (holders being plural). In other words, Lebanon, on its own, gets to add new provisions, as long as it’s doing so for the collective benefit of the holders. One might ask: Who decides whether a change is “for the benefit of the Holders”? Since Lebanon is delegated the authority to insert new clauses, without approval from either the creditors or the trustee, presumably it gets to decide.

If someone were to argue against that interpretation, Lebanon’s offering circulars from 2010 and later, which contain a summary of key contract terms, shed light. These summaries say:

– correcting, in the opinion of the trustee, a manifest error of a formal, minor or technical nature. Lebanon’s manifest error clause, drawn from its 2010 Fiscal Agency Agreement, is different.

The equivalent bits to Mexico’s clause read (with our emphasis): Without the consent of any Holder of Notes, the Republic . . . may enter into one or more Supplements for any of the following purposes (a) to add to the covenants of the Republic for the benefit of the Holders of the Notes (f) to make any other change that does not adversely affect the rights of any Holder”

If someone were to argue against that interpretation, Lebanon’s offering circulars from 2010 and later, which contain a summary of key contract terms, sheds light.

These summaries say: The Republic, without the consent of the [creditors] may make any modification to any . . . of the provisions of the Fiscal Agency Agreement which in its opinion is for any of the following purposes:

– to add to the covenants of the Republic for the benefit of the Holders . . .

A caveat here is that the offering circular is the sales document and not the contract. That said, it will be Exhibit 1 if a court decides that the clause in Lebanon’s Fiscal Agency Agreement is ambiguous and that it needs to resolve that ambiguity.

What could Lebanon do with this power? What about putting in place an aggregated voting mechanism along the lines of Greece in 2012?

That type of mechanism would allow for a binding restructuring to occur if more than 50 per cent of the creditors across all the bond series were to agree on it (a super aggregation clause).

The objection will be that adding a provision permitting, for example, a Greek-style aggregation of this bond with all the others for voting purposes cannot possibly be “for the benefit of the Holders” because, by definition, such a provision could be used to cram down the restructuring on some Holders who would otherwise have rejected it.

Of course, that argument implies that the phrase “for the benefit of the Holders” means “for the benefit of all the Holders”.

Standing alone, that would be a powerful argument. But recall, the Lebanese clause in subsection (f) says, with our emphasis:

(f) to make any other change that does not adversely affect the rights of any Holder”

This gives rise to the response: The drafters of the clause, when they wanted to require the consent of each holder, knew how to say that.

See subsection (f). But in (a) they deliberately refrained from saying that the new covenant had to benefit every holder; it only had to benefit “the Holders” as a class.

And the holders of a debt instrument — as a group — benefit from suppressing holdout-creditor opportunism. If the country does add a Greek-style aggregation provision and obtains approval by a majority of creditors of a restructuring that pays creditors a premium over market price, would that be enough to overcome legal challenges? The Greek provisions, which were inserted via legislation, survived repeated challenges in court.

$31.3 BILLION BONDS

Lebanon, one of the most indebted countries in the world, suspended payments on all $31.3 billion of its international ‘eurobonds’ in March 2020, declaring that it could no longer repay them.

In analysis published on March 24, Morgan Stanley said debt relief of 100%-125% of Lebanon’s annual economic output would be needed, though it would be far from simple.

“We see little benefit of a piecemeal approach to debt restructuring, given the complex inter-linkages between the finance ministry, central bank and domestic banks,” Morgan Stanley said in its analysis.

It floated three restructuring scenarios – soft, medium or harsh – where eurobond holders would face either a 50%, 60% or 70% writedown on their bonds and see their payment dates pushed back either five years or to 2032 or 2037 via new bonds.

This would mean the money bond holders get back – the recovery rate – will be lower than in many government debt restructurings around the world, but debt-to-GDP in Lebanon is also higher than most of those instances.

What exactly is the term : Aggregated Collective Action Clauses (CACs)

They are contractual provisions included in international sovereign bond agreements that allow a specified majority of bondholders to modify certain terms of the bond, typically in the event of a debt restructuring or other financial difficulties faced by the issuing country.

CACs were developed in response to the challenges faced during debt restructurings, particularly when a small minority of bondholders refused to agree to the proposed terms, thus hindering the resolution process. Prior to the introduction of CACs, bond agreements typically required unanimous consent from bondholders for any amendments to be made. This unanimity requirement made it difficult for countries in financial distress to reach a consensus with their bondholders, leading to prolonged and costly negotiations.

With the implementation of Aggregated CACs, a predetermined threshold or majority of bondholders (often two-thirds or three-fourths) can now approve changes to key terms of the bond, such as extending maturities, reducing interest rates, or reducing the principal amount owed. These changes, once approved by the required majority, become binding on all bondholders, including those who initially opposed the restructuring proposal.

The purpose of Aggregated CACs is to facilitate a more efficient and orderly debt restructuring process by reducing the likelihood of holdouts and ensuring that the majority of bondholders can make decisions that are in the best interest of all parties involved. By allowing a qualified majority to approve modifications, CACs provide a mechanism for overcoming the collective action problem and encourage broader participation in debt restructuring efforts.

Whatexactly is : The “manifest error” clause

The “manifest error” clause in a sovereign bond contract is a provision that allows for the correction of errors or mistakes that are deemed to be obvious or clear. It provides a mechanism for addressing errors in the terms of the bond, such as typographical errors, calculation errors, or other obvious mistakes that may have occurred during the drafting or issuance of the bond.

The purpose of the “manifest error” clause is to prevent unintended or incorrect terms from adversely affecting the rights and obligations of the bondholders or the issuing country. It recognizes that mistakes can happen and allows for their rectification in a fair and transparent manner.

Typically, the clause would outline the procedure for identifying and rectifying manifest errors. It may require the bondholders and the issuer to notify each other in writing of any identified errors and provide a specified period of time for the correction to be made. The clause may also include provisions regarding the effect of the correction on the rights and obligations of the parties involved.

The inclusion and scope of such a clause depend on the negotiations between the issuing country and the bondholders during the bond issuance process. Therefore, it is essential to refer to the specific bond contract in question to understand the exact implications and application of the “manifest error” clause.

Stephen Choi and Mitu Gulati are on the law faculties at New York University and the University of Virginia, respectively. Ugo Panizza is a professor of economics at the Geneva Graduate Institute.

Source: THE FINIANCIAL TIMES/ YA LIBNAN Reuters

Leave a Reply

You must be logged in to post a comment.