Demonstrators demand access to their savings and for the bank’s governor to be held accountable for the economic crisis.

Protesters in Lebanon have rallied in front of the central bank to demand the removal of capital controls that prevent them from withdrawing their savings and for the bank’s governor to be held accountable for the worsening economic crisis.

Angry Lebanese who rallied in the capital, Beirut, on Friday said that while politicians were able to move large sums of money outside the country, they had been left to pay for the crisis.

“People are tired and frustrated. They’ve been taking to the streets for four years now,” Al Jazeera’s Zeina Khodr, reporting from Beirut, said.

“Many do not believe they’ll see their money ever again,” Khodr said, adding that the economic woes had pushed many people to leave Lebanon.

Lebanon’s extraordinary economic breakdown became apparent in October 2019 when the central bank suddenly imposed capital controls, capping withdrawals and preventing most Lebanese from transferring money overseas.

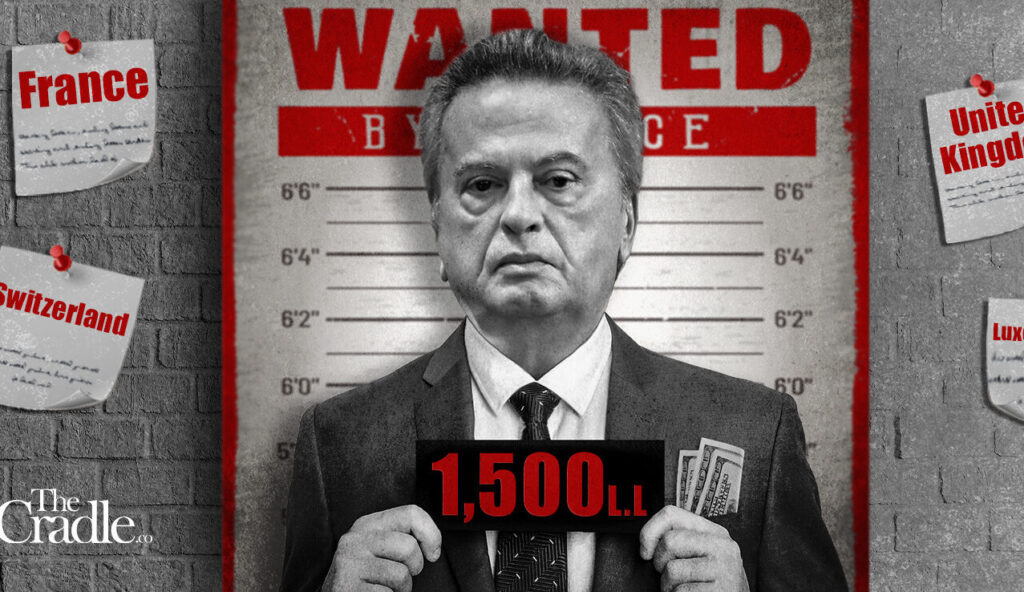

In February, the central bank confirmed a new official exchange rate of 15,000 pounds per US dollar, scrapping the rate of just more than 1,500 pounds at which the currency was pegged for decades before it collapsed.

Depositors complain that withdrawing savings at the official rate is hugely disadvantageous because the Lebanese pound has been hovering around a record 100,000 to the dollar on the parallel market, on which day-to-day transactions are made.

“I need my money to buy medication, I’m diabetic,” pensioner Micheal Iliovits told Al Jazeera. Medicine subsidies were largely lifted starting in 2021, making essential medicines unaffordable for many.

Salam Zeiban, who described himself as unemployed, said the politicians wanted the people to pay for their “theft”. “This is unethical,” he said, adding that while the people have been withdrawing their money at an “unfair” exchange rate for years, politicians were able to smuggle their money out of the country in the early days of the crisis.

Central bank Governor Riad Salameh denied reports that the country is bankrupt due to an estimated $70bn in losses to the financial system.

Salameh has been issued with international arrest warrants, but Lebanon has so far refused to extradite him. He is banned from leaving the country but remains in his position at the bank.

Besides being mired in a crippling economic crisis for more than three years, Lebanon has also been governed by a caretaker cabinet for more than a year and has been without a president for almost eight months.

Lawmakers in the parliament, where no group has a clear majority, have failed to elect a new president 12 times amid bitter divisions between Iran-backed Hezbollah and its opponents.

(AL JAZEERA/ NEWS AGENCIES)

Leave a Reply

You must be logged in to post a comment.