The world’s richest man Elon Musk, who doubles as President Donald Trump’s chief of cost-cutting, took a sizable hit to his net worth as the stock market shudders at Trump’s tariffs, causing shares of Musk’s multinational car company Tesla to flounder.

Musk’s net worth fell by $8.8 billion Thursday to $342.8 billion, according to Forbes’ real-time estimates.

Musk’s fortune is now down $121.2 billion from its end-of-day record of $464 billion set Dec. 17, when Tesla stock closed at an all-time high $480 per share.

Down 6% on the day, Tesla stock closed at just above $263, some 45% below its end-of-day record set late last year and continued to fall after the market closed for the day

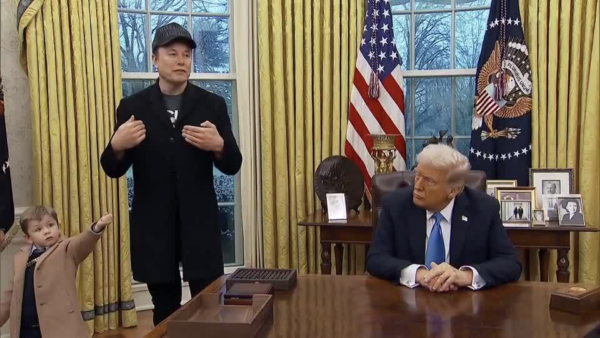

Tesla is particularly sensitive to tariffs as China is the second-largest market for its electric vehicles and the company, like other American automakers, relies on imports from Canada to produce its cars. Tariffs “will have an impact on our business and profitability” considering Tesla is “still very reliant on parts from across the world for all our businesses,” Tesla’s chief financial officer Vaibhav Taneja warned in January. Musk is arguably the most important member of Trump’s administration as the head of the Department of Government Efficiency (DOGE).

Tesla ended Thursday trading at its lowest share price since Election Day.

Tesla sales crash globally, including Germany, Australia, and China

Tesla was proudly proclaiming less than a year ago that it would be selling 20 million electric vehicles annually by 2030. Fast forward to today, and things have taken a sharp downturn. After seemingly abandoning this lofty goal mid-2024, the company has also seen its first annual sales decline in a decade. Now, Tesla’s sales are continuing to slide in several major markets, including Germany, Australia, and, China.

Earlier this week, BBC reported that Tesla sales in Norway collapsed by 44.4% through January and February, despite the country’s overall EV market growing by 53.4%. Things are even worse in Germany. New data from the KBA – Germany’s Federal Motor Transport Authority – shows that in January 2025, Tesla sales plummeted by 59.5%, with just 1,277 new cars registered in the country.

The situation only worsened in February. Sales were down a staggering 76.3% compared to February 2024, with just 1,429 units sold. Through January and February, Tesla has delivered 2,706 vehicles in Germany, marking a massive 70.6% drop from the same period last year. Tesla’s decline is even more pronounced when you consider that overall BEV sales in Germany climbed 30.8% in February.

DOGE

“Musk’s involvement with DOGE and the Trump administration broadly may affect some buyers in the US and Europe, which complicates the setup from a demand perspective,” Baird senior research analyst Ben Kallo wrote in a Thursday note to clients.

Forbes/ BBC