Image: Former President Trump’s plans would add $7.5 trillion to cumulative deficits from 2025 to 2035, according to the Committee for a Responsible Federal Budget, while Vice President Kamala Harris’ agenda would add $3.5 trillion to the tally.

Permanently extending the Trump tax cuts would cost $400 billion per year and give the largest tax cut to extremely rich households.

In December 2017, then-President Donald Trump signed into law legislation that disproportionately cut taxes for wealthy individuals and large profitable corporations—colloquially known as the “Trump tax cuts.” While the corporate provisions of that bill were largely made permanent, the portions that affect individuals were mostly temporary and are set to expire at the end of 2025.

According to new estimates released today by the Congressional Budget Office (CBO), permanently extending the expiring provisions of the Trump tax cuts would cost $4 trillion over the next 10 years, $400 billion per year.* This includes $3.4 trillion from extending the expiring individual and estate tax provisions as well as $551 billion from extending business provisions.

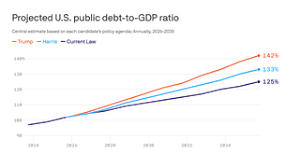

Analysis by the Center for American Progress based on the CBO figures finds that extending the Trump tax cuts would, in 2024 dollars, cost $3.2 trillion over 10 years, $6.8 trillion over 20 years, and $10.3 trillion over 30 years. By 2054, extending the Trump tax cuts would increase the projected debt-to-gross domestic product (GDP) ratio by 36 percentage points, pushing it above 200 percent of GDP. Taken together, the Bush tax cuts, their bipartisan extensions, and the Trump tax cuts would be responsible for more than 100 percent of the increase in the projected debt ratio, with the Trump tax cuts responsible for nearly one-third of the future growth in the debt ratio above 2024 levels.**

An extension would provide, on average, a larger tax cut for extremely rich households than for everyone else. Households with incomes of more than $500,000 per year—roughly the top 2 percent of households by income—would receive a larger tax cut than households making $200,000 per year, not just in dollars terms but also as a percentage of their after-tax income. And the households making $200,000 per year would receive a larger tax cut than those making $50,000 or less per year

Tax cuts that disproportionately helped the richest Americans are the entire reason debt is rising as a percentage of the economy. Congress should not double down on failed and unfair budget policy. 2025 presents an opportunity for reforms to create a more equitable tax system: Policymakers should raise revenue to ensure the wealthy and corporations pay their share, especially by paring back some of the corporate cuts previously enacted.

Leave a Reply

You must be logged in to post a comment.