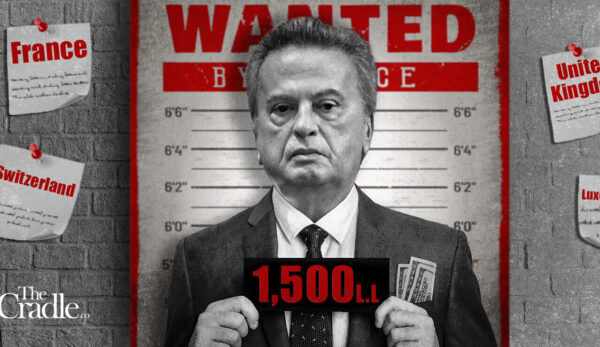

Riad Salameh who was once internationally seen as the guardian of Lebanon’s financial stability, has fallen from grace. He spent his final weeks in office a wanted man, faced with French and German arrest warrants that have been prompted by long-running corruption probes. Under Salameh the Lebanese currency lost 99 % of its value and the depositors in the Lebanese banks lost all their money despite this the corrupt Lebanese politicians always defended him and protected him .

Lebanon’s former central bank governor, Riad Salameh, was arrested in Beirut on Tuesday over alleged financial crimes linked to a brokerage company, three judicial sources said, his first arrest after years of accusations at home and abroad.

Salameh, 73, was the bank governor for 30 years but his final years were marred by charges of financial crimes, including illicit enrichment through public funds, by authorities in Lebanon and several Western countries.

Two judicial sources told Reuters the former central bank chief was accused of accruing more than $110 million via financial crimes involving Optimum Invest, a Lebanese firm that offers income brokerage services.

One source said the specific charges that led to his arrest on Tuesday were embezzlement, money-laundering and fraud as part of commissions earned through the central bank’s dealings with Optimum between 2015-2018.

Neither Salameh nor his lawyer immediately responded to requests for comment. Salameh has previously denied any accusations of financial crimes.

He will be held for four days as a “precautionary arrest” before the case is transferred to the Beirut public prosecutor, another judicial source said.

Optimum’s CEO Reine Abboud told Reuters by phone that the company had not been present at the hearing and heard about the arrest through local media.

Abboud referred Reuters to a statement on Optimum’s website that said a financial audit in late 2023 had found “no evidence of wrongdoing or illegality” in the company’s dealings with the central bank.

Tuesday’s charges are separate from previous charges of financial crimes linked to Forry Associates, a company controlled by Salameh’s brother, Raja. The brothers – who deny any wrongdoing – were accused of using Forry to divert $330 million in public funds through commissions.

Despite facing charges in Lebanon, arrest warrants in both France and Germany and an Interpol Red Notice, Salameh had never previously been apprehended.

If the case continues, it would mark a rare example of Lebanese authorities bringing a top figure to account, in a system which critics say has long shielded the elite.

Caretaker Prime Minister Najib Mikati told pan-Arab broadcaster Al-Hadath that the government would not intervene in the case.

Salameh worked closely with the Lebanon’s top politicians throughout his tenure. This led critics to doubt whether the Lebanese judiciary – where appointments largely depend on political backing – would seriously investigate him.

UNDER SANCTIONS

Two of the judicial sources told Reuters that Salameh was arrested following a hearing at Lebanon’s justice palace about the central bank’s dealings with Optimum Invest.

They said Optimum had dealt with Lebanon’s central bank to buy and sell treasury bonds and certificates of deposit with quick turnovers to make major profits.

Lebanon’s caretaker justice minister Henry Khoury told Reuters that he did not have details of the file.

“There is no doubt that the Public Prosecutor did what was required of him and interrogated former governor Riad Salameh,” he said.

After taking the helm of the central bank following a devastating 15-year civil war, Salameh built a reputation as a competent steward of the financial system and was once seen as a possible president.

After he left office, the United States, Britain and Canada announced sanctions against him, accusing him of corrupt actions to enrich himself and his associates – allegations he also denied at the time.

His fall mirrors that of Lebanon’s financial system, which collapsed five years ago and now faces an appraisal by a financial watchdog in the coming weeks that could place it on a “grey list” warranting additional scrutiny.

One of the main gap areas identified by the Financial Action Task Force was a lack of judicial action on alleged financial crimes.

A diplomatic and a judicial source said they viewed Salameh’s arrest as a potential attempt to try to show FATF appraisers something was now being done.

Reuters

Leave a Reply

You must be logged in to post a comment.