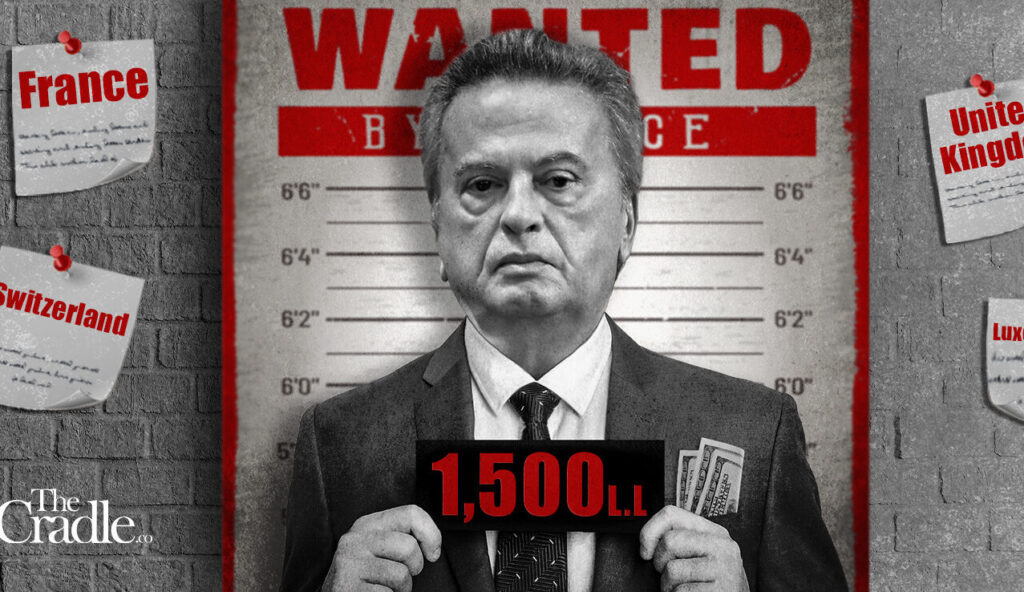

Lebanon’s embattled central bank governor stepped down Monday under a cloud of investigation and blame for his country’s economic crisis as several European countries probe him for alleged financial crimes.

Riad Salameh, 73, ended his 30-year tenure atop the central bank as tearful employees took photos and a band played celebratory music with drums and trumpets.

In that same building, his four vice governors, led by incoming interim governor Wassim Mansouri, quickly pivoted to urge fiscal reforms for the cash-strapped country.

“We are at a crossroads,” Mansouri said at a news conference. “There is no choice if we continue the previous policy … the funds in the Central Bank will eventually dry up.”

Seventy-three-year-old Riad Salameh kicked off his tenure as central bank governor in 1993, three years after Lebanon’s bloody 15-year civil war came to an end. It was a time when reconstruction loans and aid were pouring into the country, and Salameh was widely celebrated at the time for his role in Lebanon’s recovery.

Now, he leaves his post a wanted man in Europe, accused by many in Lebanon of being the main culprit in the country’s financial downfall since late 2019.

It was a steep fall for a leader whose policies were once hailed for keeping the currency stable. Later, many financial experts saw him as setting up a house of cards that crumbled as the country’s supply of dollars dried up on top of decades of rampant corruption and mismanagement from Lebanon’s ruling parties.

The crisis has pulverized the Lebanese pound and wiped out the savings of many Lebanese, as the banks ran dry of hard currency.

With the country’s banks crippled and public sector in ruins, Lebanon for years has run on a cash-based economy and relied primarily on tourism and remittances from millions in the diaspora.

Mansouri said previous policies that permitted the Central Bank to spend large sums on money to prop up the Lebanese state is no longer feasible. He cited years of spending billions of dollars to subsidize fuel, medicine, and wheat and more to keep the value of the Lebanese pound stable.

Instead, Mansouri proposed a six-month reform plan that included passing long awaited reforms such as capital controls, a bank restructuring law, and the 2023 state budget.

“The country cannot continue without passing these laws,” Mansouri explained. “We don’t have time, and we paid a heavy price that we cannot pay anymore.”

The reforms Mansouri mentioned are among those the International Monetary Fund set as conditions on Lebanon in April 2022 for a bailout plan, though he did not mention the IMF. None have been passed.

France, Germany, and Luxembourg are investigating Salameh and his associates over myriad financial crimes, including illicit enrichment and the laundering of $330 million. Paris and Berlin issued Interpol notices to the central bank chief in May, though Lebanon does not hand over its citizens to foreign countries.

Salameh has repeatedly denied the allegations and insisted that his wealth comes from his previous job as an investment banker at Merrill Lynch, inherited properties, and investments. He has criticized the probe and said it was part of a media and political campaign to scapegoat him.

In his final interview as governor, Salameh said on Lebanese television that the responsibility for reforms lies with the government.

“Everything I did for the past 30 years was to try to serve Lebanon and the Lebanese,” he said. “Some — the majority — were grateful, even if they don’t want to say so. And there are other people, well may God forgive them.”

Salameh’s departure adds another gap to crisis-hit Lebanon’s withering and paralyzed institutions. The tiny Mediterranean country has been without a president for nine months, while its government has been running in a limited caretaker capacity for a year. Lebanon has also been without a top spy chief to head its General Security Directorate since March.

Lebanese officials in recent months were divided over whether Salameh should stay in his post or whether he should step down immediately in the remaining months of his tenure.

Caretaker Economy Amin Salam wanted the latter, given that the central bank chief had a “legal question mark.”

“I cannot explain anyone holding on to a person while a nation is failing unless there is something wrong or hidden,” Salam told The Associated Press.

France24/AP

Leave a Reply

You must be logged in to post a comment.