Investigations at home and abroad offer hope of justice for the country’s crisis.

By Dario Sabaghi,

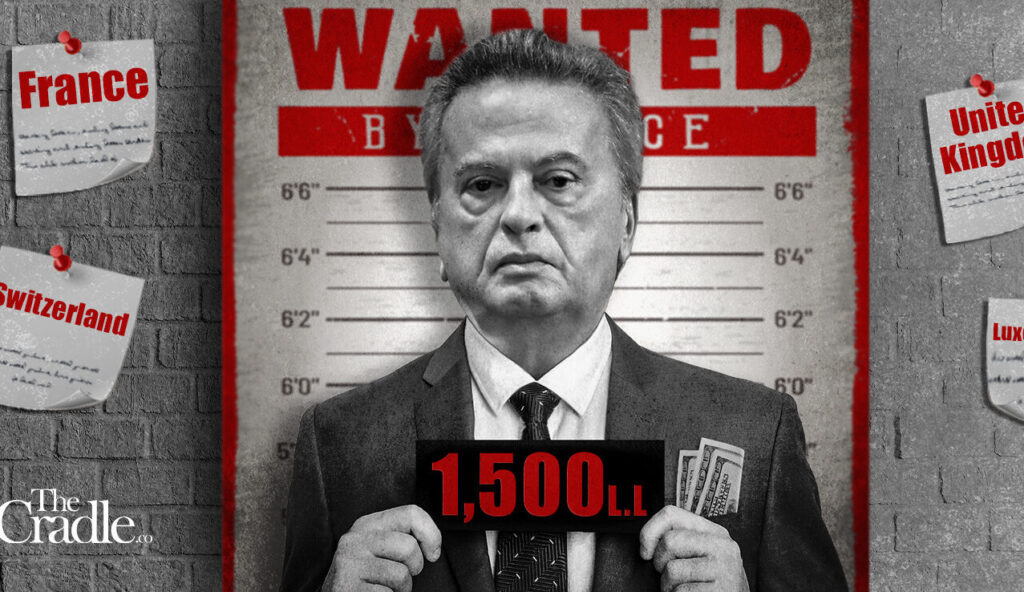

For more than three years, Lebanese citizens have continued to stage sporadic protests amid a dire economic crisis, directing their rage at the country’s political elite. One of the most prominent targets is Riad Salameh, the governor of Banque du Liban, Lebanon’s central bank. Posters at demonstrations across the country regularly feature Salameh’s face, whether stained with a bloody handprint or depicted in a fake mugshot. The message is clear: Lebanon’s protestors want Salameh out of power—and held to account.

Salameh has headed Lebanon’s central bank for nearly 30 years. Now, he faces the prospect of prison time. On May 16, France issued an arrest warrant for Salameh over his failure to appear for questioning before investigators in Paris. The country launched a corruption investigation into Salameh and his associates over, among other things, the alleged laundering of more than $330 million from Lebanon’s public funds for personal use, including the purchase of luxury properties in Europe. The next week, Germany issued its own arrest warrant. Salameh has denied any wrongdoing.

Although Lebanon does not extradite its citizens, investigations into Salameh’s alleged crimes—including embezzlement, money laundering, illicit enrichment, and tax evasion—that are underway in Lebanon and six European countries may mark a turning point for Lebanon. For years, many Lebanese have felt hopeless about the country’s political and economic quagmire. Virtually no one among the Lebanese elite has faced any repercussions for their role in the crisis and its devastating impact on Lebanon’s population. But these probes may bring about, for the first time in years, some accountability. For many Lebanese, it’s a small sign that change could be coming.

Salameh played a central role in the meltdown of Lebanon’s financial system that came to a head in 2019. “He is the author of a monetary policy put in place that led to a deep financial crisis,” said Sami Nader, director of the Levant Institute for Strategic Affairs.

Lebanon’s financial crisis built over a period of years. In 1997, the country pegged its currency to the U.S. dollar at a fixed rate of 1,507 to 1. At first, the peg stabilized inflation, but over time, it led to the overvaluation of the Lebanese pound. It also meant that Lebanese banks needed large stores of U.S. dollars—stores that started to dwindle as remittances from the Lebanese diaspora decreased and foreign investment fell amid regional political tensions in the 2010s.

To stabilize the Lebanese pound, in 2016, Salameh implemented “financial engineering,” a set of policies that involved banks offering a high return on U.S. dollar deposits to maintain dollar reserves. But this reduced lending to the real economy and was ultimately financed by Eurobond sales, resulting in a decrease in Lebanon’s net reserves. The country’s attempts to raise U.S. dollars to pay off its debts were described by economists and even French President Emmanuel Macron as a Ponzi scheme. Meanwhile, despite warnings from the International Monetary Fund (IMF) and the World Bank, Lebanon’s central bank continued to fund the government’s lavish spending.

“Lebanon’s political and banking establishments worked together to implement policies that primarily benefited themselves,” Nader said. Ordinary Lebanese people by contrast, only got poorer.

A proposed tax on WhatsApp calls finally sparked the mass protests that began in October 2019. Lebanese were fed up with the government, banks, and business elites. Although Salameh was not involved in the tax decision, protesters viewed him as being part of the corruption that caused the economic collapse. “Politicians, bankers, and the central bank are all part of a network where they know and communicate with each other,” Lebanese economist Roy Badaro said. Close links between politicians and the banking sector in Lebanon were detailed in a 2021 statement by Olivier De Schutter, the United Nations special rapporteur on extreme poverty and human rights.

It wasn’t until January 2021 that Salameh’s legal troubles abroad began, when Switzerland requested legal assistance from Lebanon to look into bank transfers made between 2002 and 2015 by Salameh, his brother Raja, and their former associate Marianne Hoayek. Since then, Switzerland has been investigating Salameh for the alleged embezzlement of public funds through Forry Associates Ltd—a company owned by his brother that served as a broker for Lebanon’s central bank.

The Swiss investigation led to other countries in Europe—Belgium, France, Germany, Liechtenstein, and Luxembourg—investigating Salameh as well. In March 2022, European states froze around $130 million in Lebanese assets connected to the probes. If found guilty, Salameh could face up to 10 years in prison and have his assets in Europe confiscated.

After Switzerland requested their cooperation, Lebanese authorities opened their own probe, beginning with an 18-month preliminary investigation by Lebanese prosecutor Jean Tannous in 2021—the same year a separate investigation was started by Lebanese Judge Ghada Aoun. Then, this February, Lebanese Judge Raja Hamouche charged the Salameh brothers and Hoayek with corruption; and in March, the Lebanese state, represented by Judge Helena Iskandar, filed a complaint against the Salameh brothers on charges of bribery, fraud, money laundering, embezzlement, and tax evasion. The complaint aims to transfer any confiscated property abroad to Lebanon if Salameh is convicted in Europe and protect Lebanon’s rights. European and Lebanese judges are cooperating in line with the mutual legal assistance decreed by the U.N. Convention Against Corruption to collect and exchange information.

Salameh’s alleged use of public funds is just the tip of the iceberg, said Zena Wakim, a lawyer for Accountability Now, a Swiss foundation that aims to end the impunity of Lebanese leaders and that filed legal complaints against Salameh in Europe.

“European investigators now are realizing that a larger corruption network exists,” she said. “[Salameh] was charged with aggravated money laundering, which means that a professional network of criminals is involved in the embezzlement. Although the investigation currently focuses on Salameh, we can see that it is starting to spread to other politicians in Lebanon.”

Already, in April, French prosecutors announced that they had launched a formal investigation into Marwan Kheireddine, a Lebanese banker and former minister who chairs Lebanon’s Al-Mawarid Bank. He is suspected of allowing Salameh to process irregular fund transfers through the bank.

Although Lebanon remains largely stuck in a political quagmire, the European investigations show that figures such as Salameh are no longer untouchable. Since the financial implosion, Lebanese have fought, mostly unsuccessfully, to hold those in power to account. Now, justice—however limited—might finally be possible in Lebanon.

Even the Lebanese elite know that they can’t fully ignore the international pressure. Lebanon doesn’t extradite its nationals, so it’s unlikely Salameh will be arrested in Europe, but domestic pressure for him to resign is mounting. In Lebanon, Deputy Prime Minister Saade Chami, Parliament Deputy Speaker Elias Bou Saab, and Hezbollah leader Hassan Nasrallah, along with several ministers and MPs, have called for Salameh to resign.

It’s a strange quandary for Lebanon’s political class, which supported Salameh for decades. Lebanese elites are likely wary of turning against Salameh, since he could reveal information about other elites involved in the economic meltdown. But at the same time, they know they have to take action against Salameh to bolster Lebanon’s reputation in the international community—especially amid ongoing talks for a bailout package with the IMF. As Chami told the Associated Press, the allegations against Salameh “could threaten the country’s financial relations with the rest of the world.”

Salameh, for his part, said he will only resign before the end of his term if he is convicted. But even if that doesn’t happen, the investigations have already brought a hint of change. In February, Salameh said he would step down from his position at the end of his current term in July.

The Lebanese investigations, meanwhile, may have less of an impact. Lebanon’s judiciary has long faced accusations of political interference. For months, investigators have faced roadblocks, culminating in the judiciary’s disciplinary council decision in May to remove from office Aoun, who brought charges against Salameh, other Lebanese political figures, and commercial banks. Aoun told Reuters the disciplinary council had accused her of bias due to her comments about corrupt officials.

Aoun has appealed the decision and will hold her position until a final ruling is made. In the meantime, she has filed new charges of illicit enrichment against Salameh, his wife Nada Karam, and Lebanese actress Stephanie Saliba. She also filed a complaint last month against Lebanon and Gulf Bank.

Whatever the investigations’ outcome, their very existence symbolizes an opportunity to challenge the system of impunity that protects Lebanon’s elites while shedding light on the flaws within the country’s justice system. As Badaro said, “We need to re-examine our past to build a solid state and ensure no impunity for the future or past, including all actors in the corruption scheme.” The investigations may be the first step in doing that.

Foreign Policy

Leave a Reply

You must be logged in to post a comment.