Lebanon is considering a move to allow holders of dollar accounts at banks to withdraw money in pounds at a weaker rate than the official peg, nearing a milestone decision on devaluation after opting not to repay a Eurobond due this month.

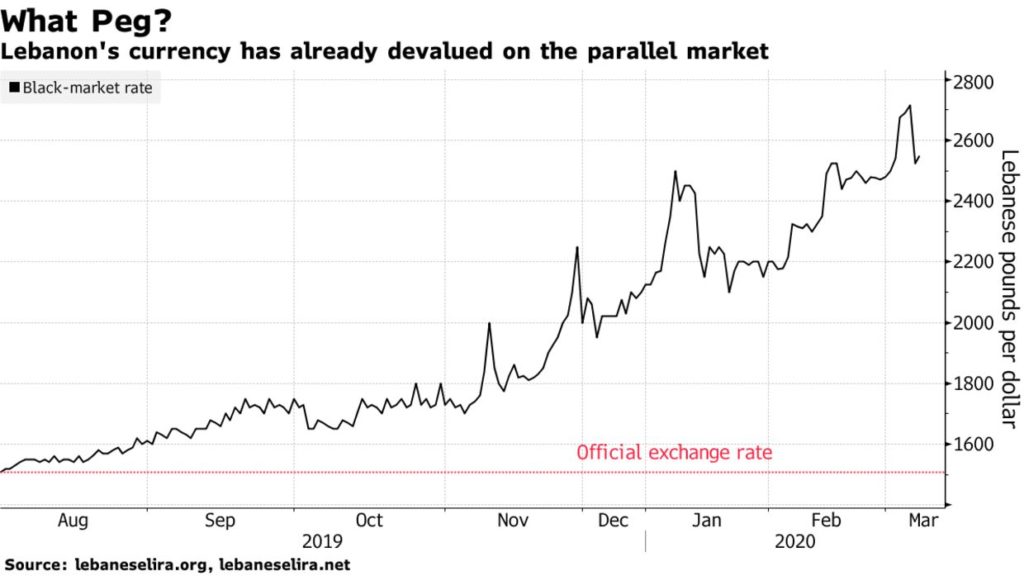

Under the proposal, clients with U.S. currency accounts would withdraw funds at the rate of 2,000 pounds per dollar, compared with the decades-old fixed-exchange regime of 1,507.5, according to people familiar with the matter. They said the plan has the aim of asserting control over the black-market rate that remains over 2,500.

The measure was discussed during a meeting between bankers and the public prosecutor last week after the two sides approved a set of decisions to ease banking restrictions, according to two people familiar with the matter. It requires a central bank circular to go into effect.

A person who attended the talks said the step is meant to curb demand for dollars that are no longer available at banks. The central bank didn’t respond to a request for comment.

The public prosecutor has been probing banks over three cases including their months-long restrictions on the movement of capital that were seen as illegal. Banks agreed with the judiciary to ease curbs on pound withdrawals and allow some transfers abroad and discussed potentially changing the rate for dollar accounts.

Lebanon is at another turning point after announcing this month that it won’t pay a maturing Eurobond in what would the first default in its history. A seven-day grace period on the bond ends Monday. The country went into lockdown this week, further paralyzing an economy disrupted since protests against corruption erupted last year.

As the government now looks to restructure $90 billion in debt, dismantling the peg is likely to be among the centerpieces of an economic program meant to contain a financial meltdown. Finance Minister Ghazi Wazni has told Reuters the government would like to keep the peg to control inflation but that it would later consider a flexible policy.

“We assess pressure on the Lebanese pound’s currency peg to be acute, pointing to a possible abrupt and very large change in the exchange rate,” Moody’s Investors Service analysts said in a report. “An exchange-rate adjustment could form part of a comprehensive economic adjustment plan.”

The government is soon expected to finalize a draft law that would enshrine the informal capital controls jointly imposed by lenders to prevent a run on deposits amid nationwide protests in October. Local media have reported that the legislation will give the central bank exceptional powers to manage the crisis.

The government’s economic plan will likely be presented to the International Monetary Fund, whose experts recently held meetings in Beirut. Wazni said last week that the cabinet is open to an aid program from the IMF if it’s not tied to austerity measures or political conditions.

Iran-backed Hezbollah, which holds great sway in government and parliament, said it had no problem with IMF help as long as the program doesn’t undermine the sovereignty of the country or impose unreasonable demands.

With the exception of the funding made available to importers of essentials such as fuel and medicine, the peg has in effect broken already, undone by the lack of sufficient hard-currency reserves and a decline in remittances.

Rescue Plan

The government is soon expected to finalize a draft law that would enshrine the informal capital controls jointly imposed by lenders to prevent a run on deposits amid nationwide protests in October. Local media have reported that the legislation will give the central bank exceptional powers to manage the crisis.

The government’s economic plan will likely be presented to the International Monetary Fund, whose experts recently held meetings in Beirut. Wazni said last week that the cabinet is open to an aid program from the IMF if it’s not tied to austerity measures or political conditions.

Iran-backed Hezbollah, which holds great sway in government and parliament, said it had no problem with IMF help as long as the program doesn’t undermine the sovereignty of the country or impose unreasonable demands.

Peg Unravels

With the exception of the funding made available to importers of essentials such as fuel and medicine, the peg has in effect broken already, undone by the lack of sufficient hard-currency reserves and a decline in remittances.

The dollar shortage led to the emergence of a black-market rate much weaker than the peg, which breached 2,700 per U.S. currency earlier this month.

Authorities, however, seem to be drawing the line at 2,000 in preparation for a possible devaluation. Days ago, a central bank circular only allowed exchange bureaus to buy dollars at that level. The Lebanese army on Saturday detained money changers who deviated from the 2,000 per dollar mark, according to Lebanon’s state news agency.

While a currency adjustment may be a step toward eventually returning the economy to health, Moody’s has warned of upheaval ahead, estimating that a one-off 20% devaluation would push government debt to almost 200% of gross domestic product.

“In practice, the shock would likely be larger as a large depreciation would deepen the economic downturn and contribute to very high cost of debt,” it said. “Over time, greater competitiveness could support the long-term growth outlook.”

BLOOMBERG

Leave a Reply

You must be logged in to post a comment.